Weekly Sector Spotlight: US Assembled Vehicle Trends

Carbon Arc Datasets: Vehicle Registrations, SMB Workforce, Carvana Listings

Red State Consumers Driving the Transition to Domestically-Assembled Vehicles

September 3, 2025

US Assembled Vehicles

Executive Summary

The auto market is a bellwether of the American consumer. Vehicles are not just big-ticket personal investments – they represent a significant portion of household balance sheet and monthly spend. Vehicles are also cultural symbols, whether a pickup truck, minivan, EV, or BMW. With Carbon Arc’s vehicle registration data, Carvana listings data, and Small & Medium Business (SMB) workforce data, consumer health and preferences can be tracked in real-time as they are shaped by changes to supply chains and vehicle offerings.

Key Takeaways

-

Consensus is that automakers haven't raised prices following policy and supply changes in spring 2025, suggesting that tariffs have not begun to affect vehicle purchasing decisions1,2. However, our registration data from June suggests consumers are already expressing a changing preference in favor of vehicle models currently assembled in the U.S.

-

Changing vehicle preferences are more prominent in red states, with an 18pp spread in June Y/Y growth between U.S.-assembled and imported models, vs. a 7pp spread in blue states.

-

Despite the trend towards American-made vehicles, American brands only marginally outgrew foreign brands in June, with little difference between red and blue state consumers.

-

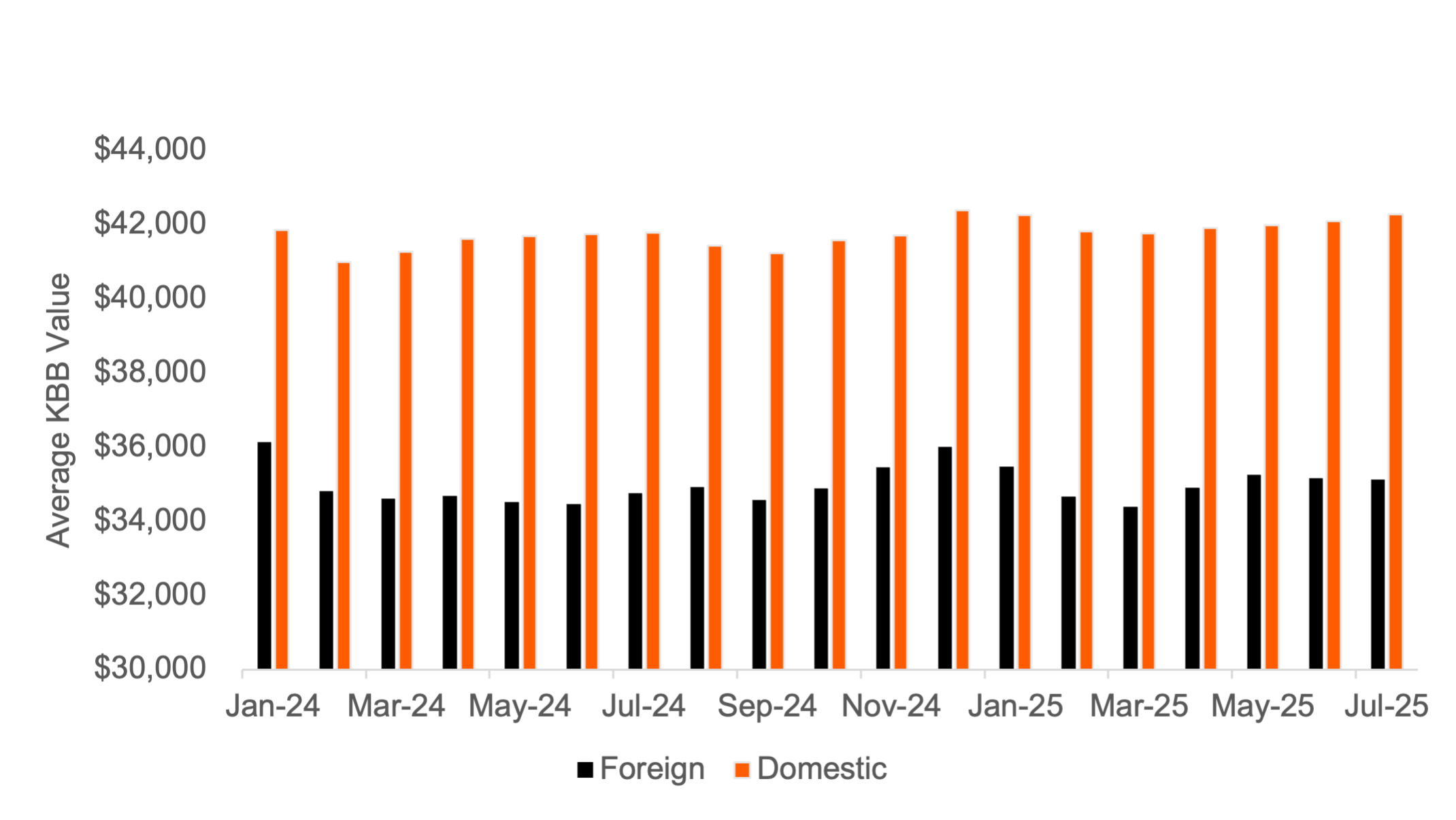

On average, the mix of domestically-made vehicle models purchased by consumers has a higher price than the mix of imported vehicles, and consumers in both red and blue states have shifted to a more-expensive mix of vehicle models.

-

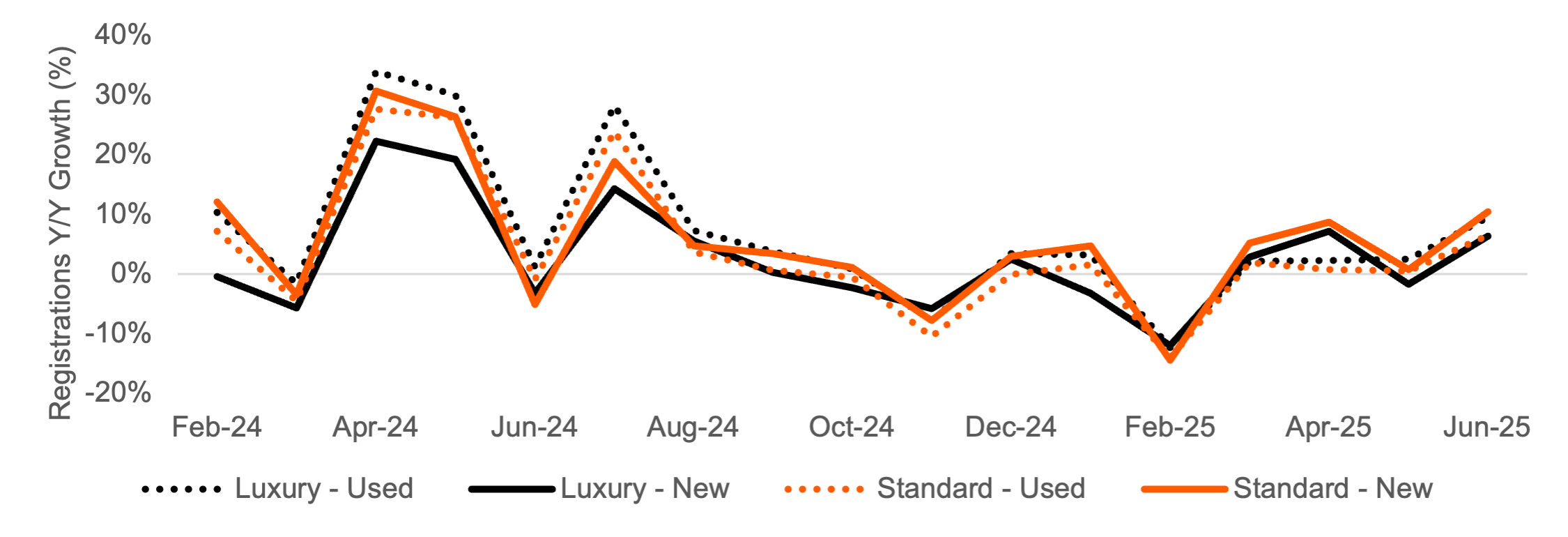

From a broader market perspective, U.S. consumers have been shifting away from new luxury vehicles for at least the last 18 months, suggesting a long-term trend towards finding better value from vehicle purchases.

-

While payroll data shows red states have had consistently greater workforce growth since 2021, state-wide political biases appear to have a greater influence on preference for US-assembled car models.

Shifting Themes in Vehicle Registration Data

Several factors evolving from new legislation, supply chain disruptions, and potential impacts from tariffs are likely having an impact on ultimate cost, and hence car buyers' decisions. Vehicle registration data is a key component in understanding how high-level political policy shifts and geo-economic factors may be influencing consumer behavior in the auto market. The following data highlights differing growth rates in new vehicle registrations, segmented at the state-level by political biases.

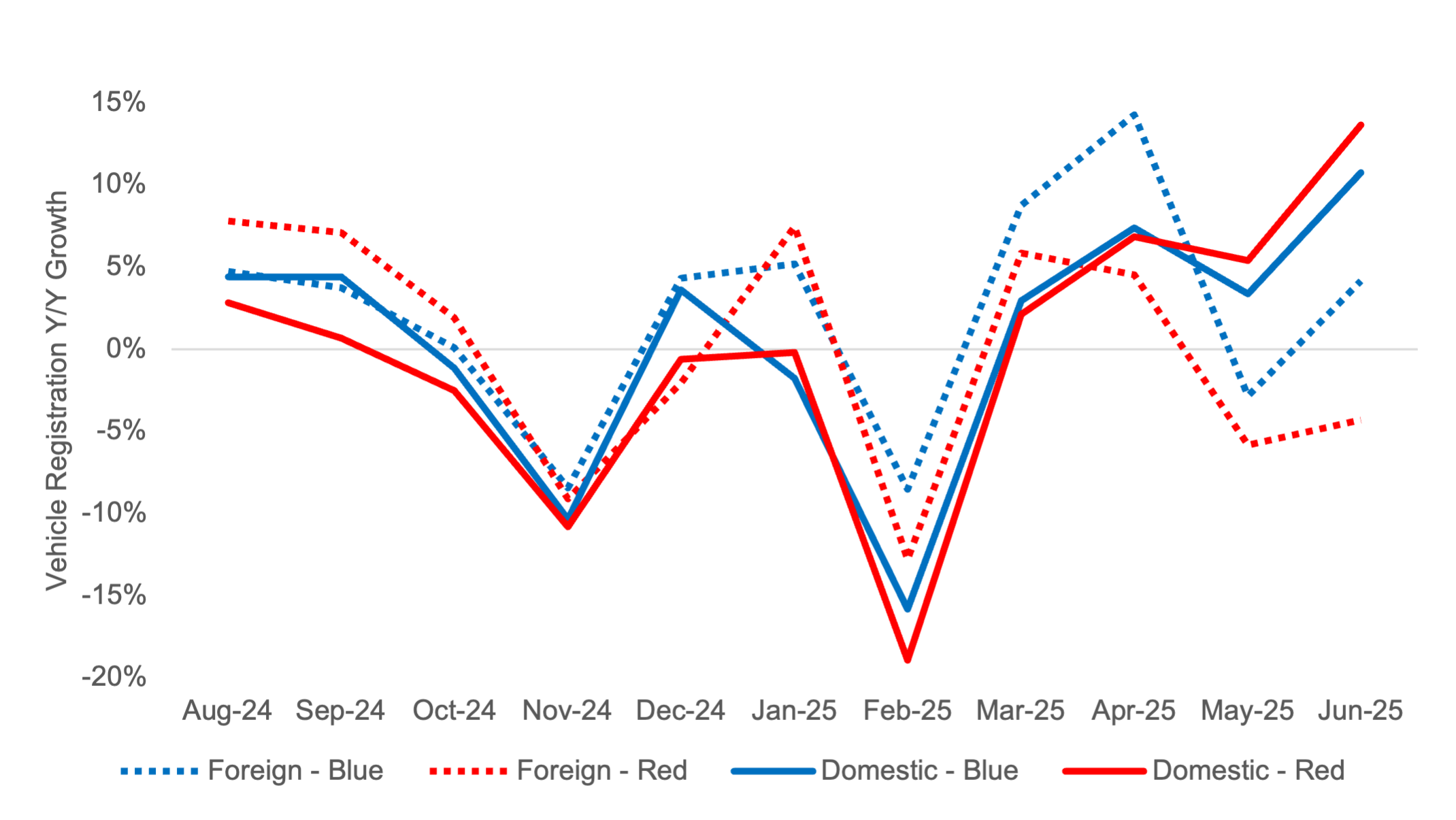

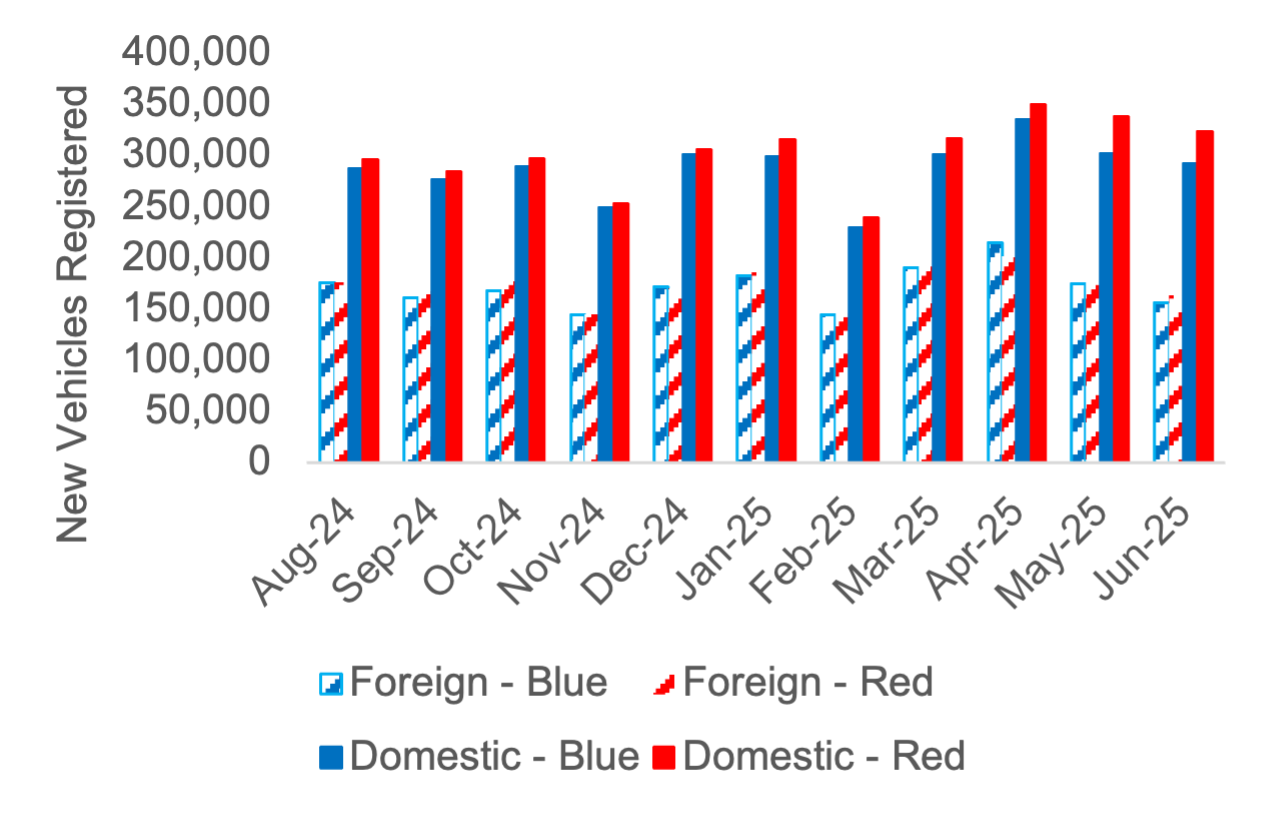

We further illustrate this theme by looking at the underlying composition of vehicle registrations. The data shows that while a similar number of imported vehicles have been registered in both red and blue states each month, and red states have maintained a slightly higher number of domestically assembled registrations, there is a widening gap favoring domestically-assembled vehicles, becoming most prominent in May and June, and that gap is more evident in red states vs. blue.

In May and June, across both red and blue states3, domestically-assembled vehicles4 gained significant share against imported vehicles. This theme was significantly more pronounced in red states, with an 18-percentage point (pp) spread (+14% vs. -4%) in June Y/Y growth vs. a 7-pp spread (+11% vs. -4%) in blue states. Registration of foreign-made vehicles has grown faster in blue states than red states in almost every month since the 2024 election.

Exhibit 1a: New Vehicle Registration Growth for Domestically-Assembled vs. Imported Vehicles

Exhibit 1b: New Vehicle Registrations for Domestically-Assembled vs. Imported Vehicles

Breakdowns by Brand and Vehicle Class

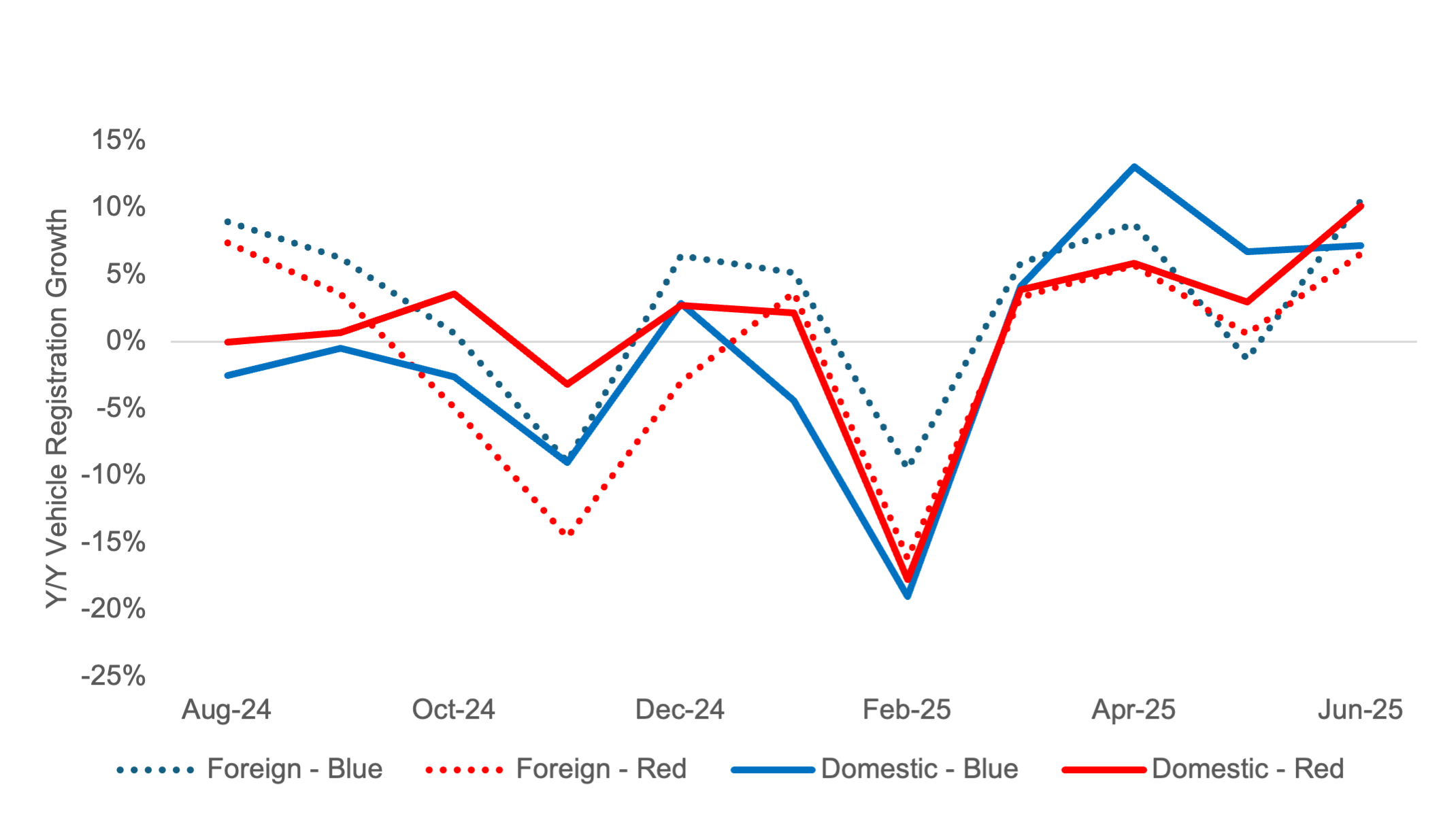

Despite the noticeable shift in preference for domestic- vs. foreign-assembled vehicles, y/y growth of registrations for American brands is barely outpacing foreign counterparts. The implication being that while macro forces may be shifting consumer preference increasingly towards domestic production, those same forces have less impact on supporting American brands. Even simpler, the shifting policies highlight the notion that Made in America is more important (fiscally beneficial) than made by an American company.

Exhibit 2: New Vehicle Registration Growth for Domestic5 vs. Foreign Vehicle Brands

In the new vehicle market, y/y growth rates for registrations of non-luxury brands6 were increasingly higher in May and June than for luxury brands. The fastest growing category in 2024 was used luxury vehicles, which are still outpacing non-luxury vehicles in the used market in 2025. This downward trend at the top end of the market contrasts with the shift towards more expensive American-made vehicles, illustrated in the appendix.

Exhibit 3: New vs. Used Vehicle Registration Growth by Class

SMB Payroll Trends and Consumer Preferences (1/2)

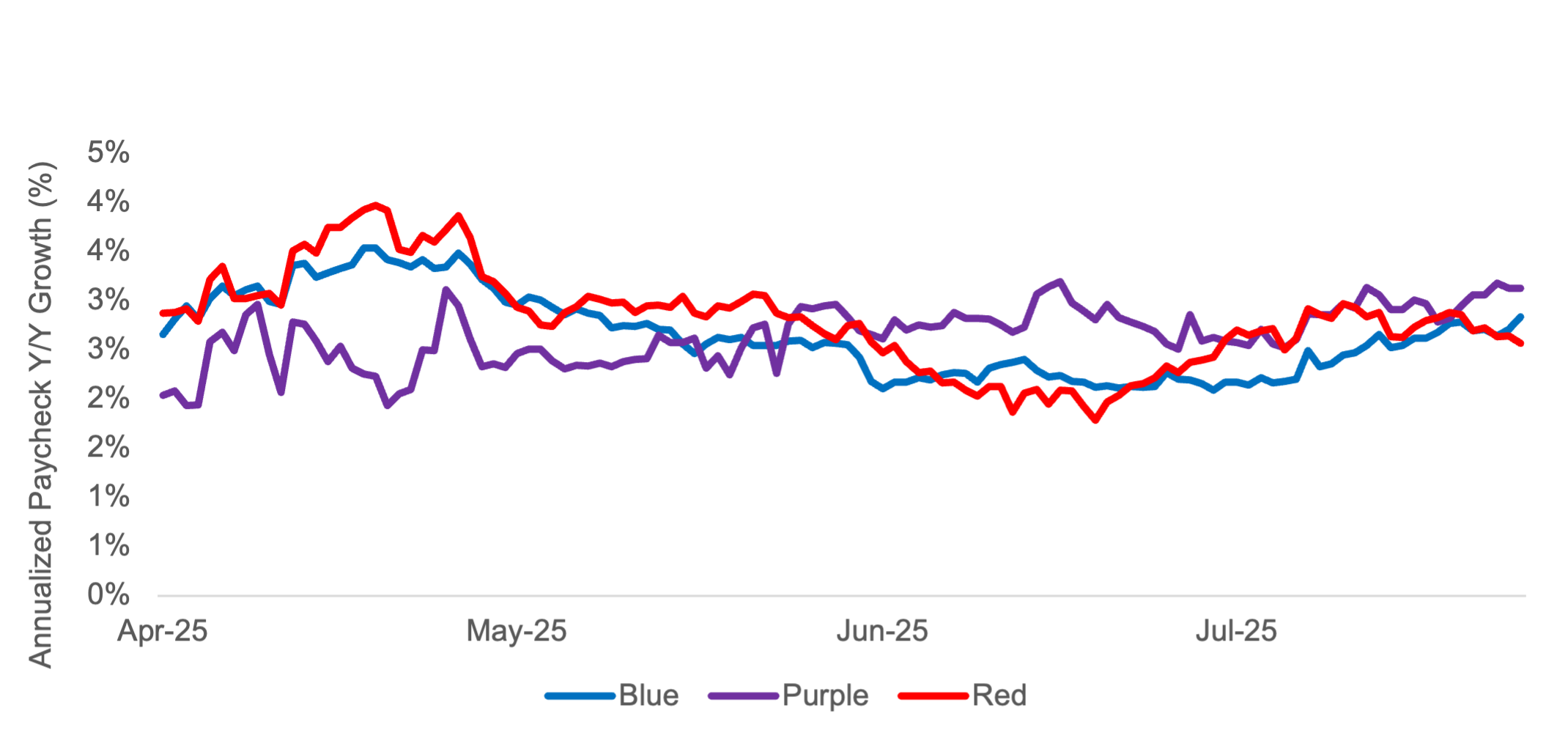

Using Carbon Arc's SMB payroll data (Paychex), we can also explore the relationship between paycheck and workforce growth and the shift towards domestically-made vehicles. Kelley Blue Book (KBB) data suggests domestically-assembled vehicles are generally more expensive (see appendix). Even with a dip early in 2025, y/y paycheck growth rates have been higher in red states vs. blue, including rising at a faster rate prior to the most recent registration data.

Exhibit 4: Trailing 28-Day Annualized Paycheck Growth by State Political Bias

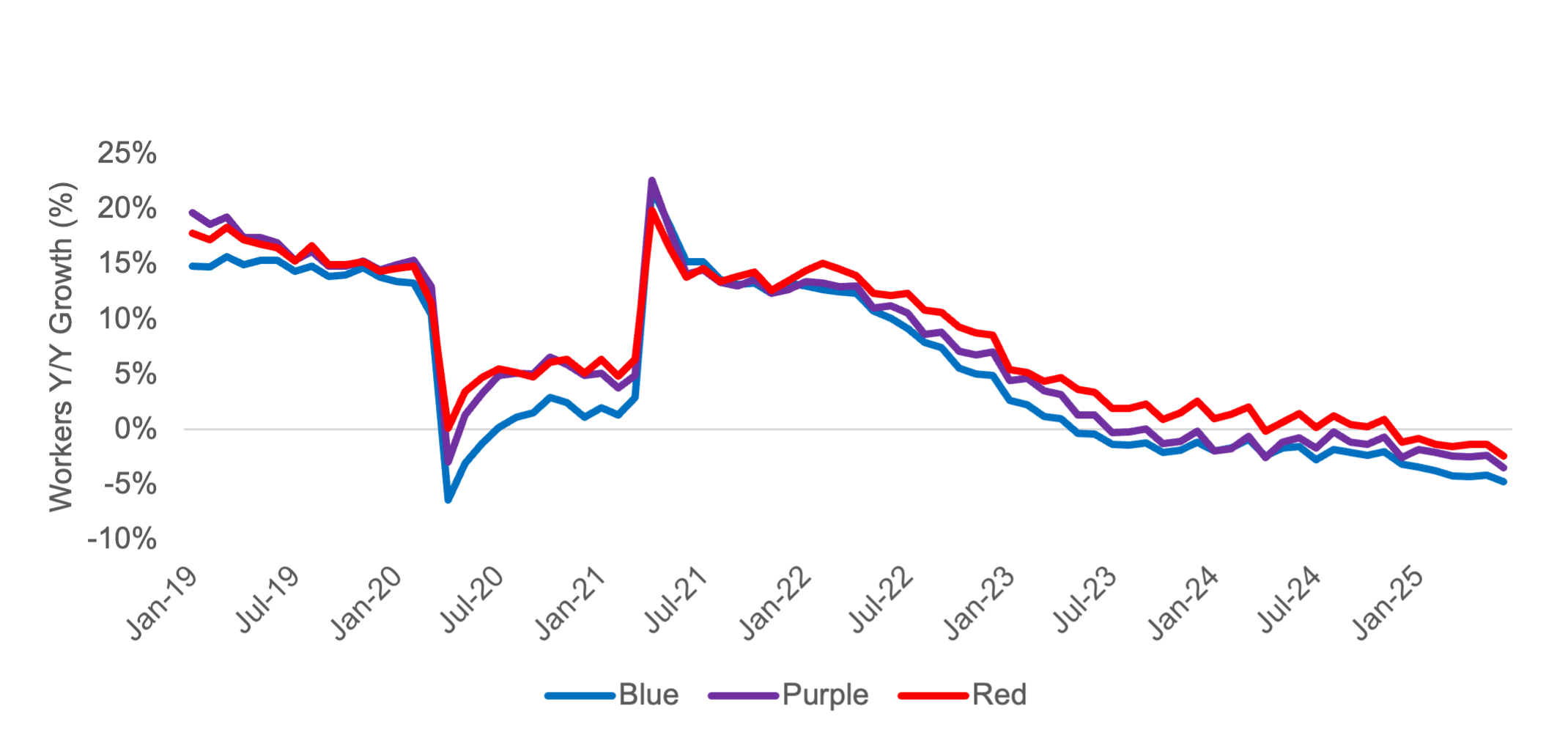

Despite all state groupings have shown Y/Y SMB employment declines in 2024, red states have shown greater employment growth vs. blue and purple states since 2021.

Exhibit 5: SMB Workforce Worker Growth by State Political Bias

SMB Payroll Trends and Consumer Preferences (2/2)

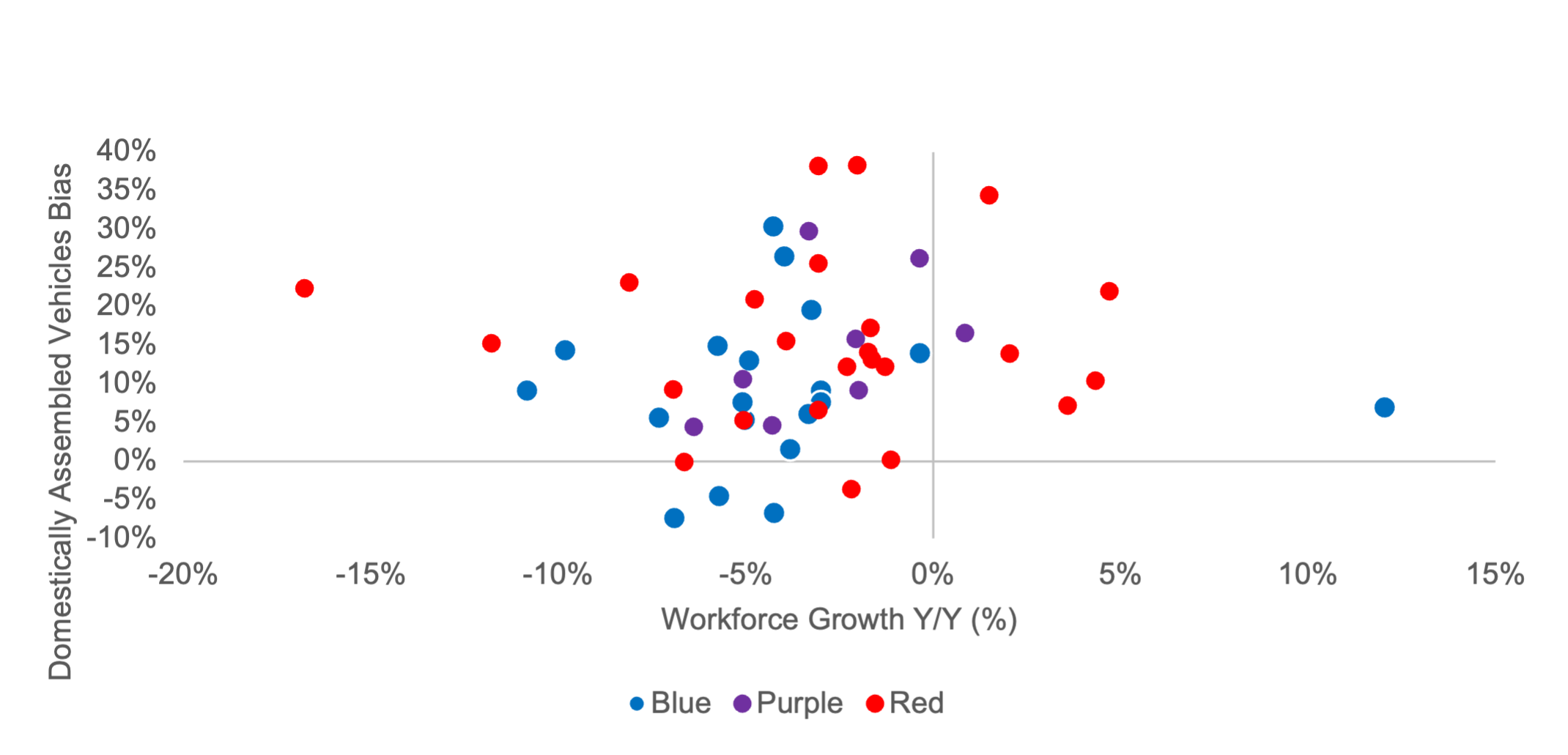

However, when breaking out data by state, there is no apparent relationship between workforce growth and trends in domestically-assembled vehicles. The top states for growth in domestically-made vs. imported vehicles are red states yet vary significantly in Y/Y workforce growth. U.S. Assembly bias is calculated as the y/y growth rate difference between domestically-and internationally-assembled vehicles.

Exhibit 6: US Assembly Bias Correlation with SMB Workforce Growth, June 2025

Appendix

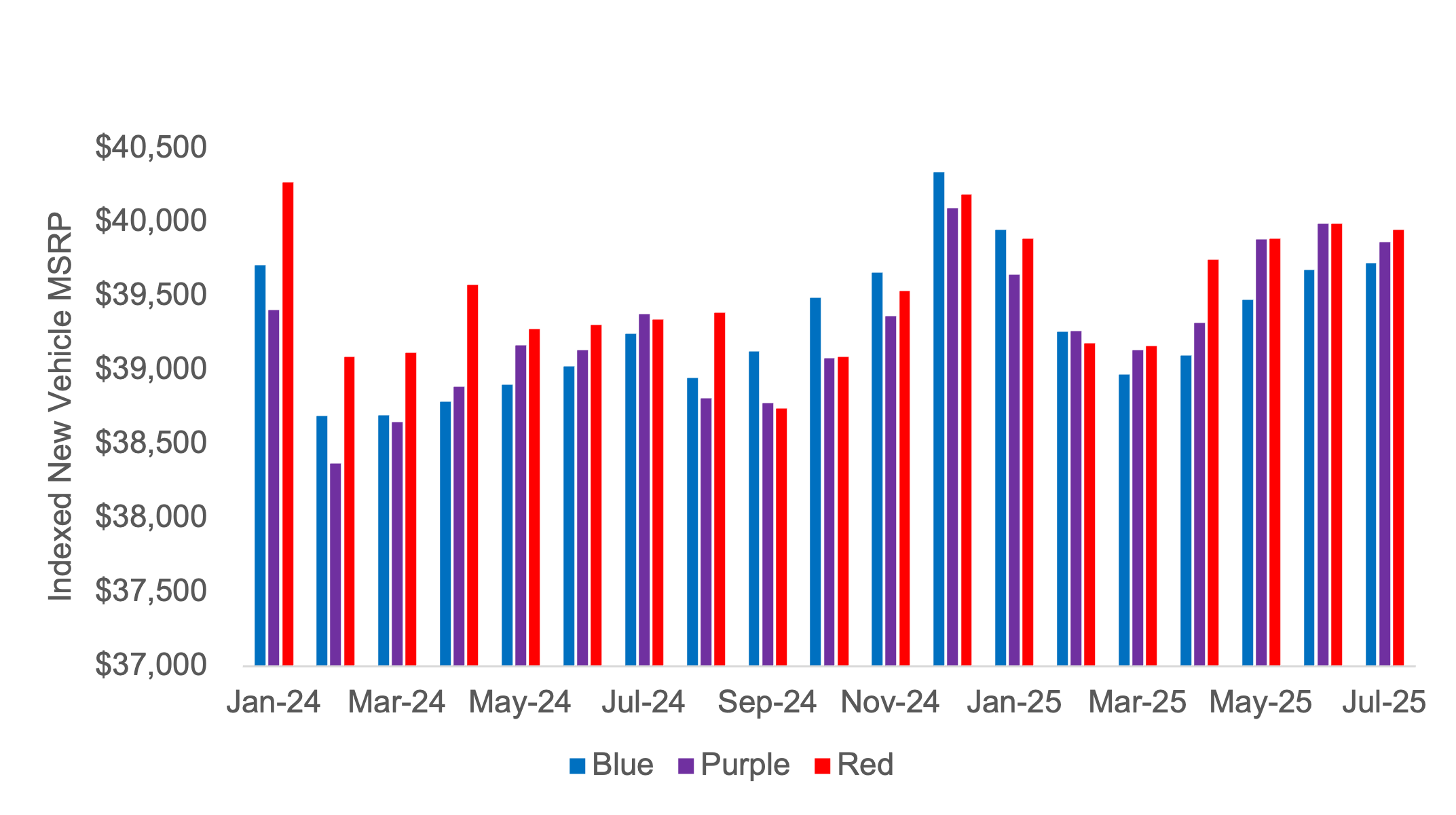

Americans registered more-expensive vehicle models in 2Q25 than in 2Q24, as MSRPs increased ~1.5% Y/Y in both red and blue states each month of the quarter. This does not account for any price increases from 2025 models over their 2024 counterparts and indicates consumer preferences and not costs are driving the shifts in domestic vs. imported vehicles.

Exhibit 7: Average Indexed MSRP Value of New Vehicles by State Political Bias, Indexed to Nov-24 Average KBB Value by Model

Indexed MSRP based on the average KBB value of Nov-24 listings of 2024 models of that vehicle.

Exhibit 8: Average KBB Value for 2024 Models, Used Vehicle Sales by Vehicle Assembly Location

References

- Washington Post. “Tariffs Cost GM, Stellantis Billions in Profits Under Trump.” Washington Post Business, July 22, 2025. https://www.washingtonpost.com/business/2025/07/22/tariffs-cost-gm-stellantis-profits-trump/

- Wall Street Journal. “Auto Industry Takes $12 Billion Hit From Trade War.” Wall Street Journal Business – Autos, 2025. https://www.wsj.com/business/autos/auto-industry-trump-tariff-impact-955ca0bf

- Political Bias by State: Defined as red, blue, or purple according to U.S. presidential election results, 2016–2024. Purple states include NH, NC, GA, PA, MI, WI, AZ, NV. List of Domestically Assembled Vehicles: CarEdge. Cars Made in America in 2025. CarEdge Guides, 2025. https://caredge.com/guides/cars-made-in-america-in-2025

- Domestic Vehicle Brands: Tesla, Ford, Lincoln, GMC, Buick, Cadillac, Chevrolet, Jeep, Chrysler, Dodge, Ram

- Non-Luxury Brands: Defined for this analysis as Buick, Chevrolet, Chrysler, Dodge, Fiat, Ford, GMC, Honda, Hyundai, Jeep, Kia, Mazda, Mini, Mitsubishi, Nissan, Ram, Subaru, Toyota, and Volkswagen.

Methodology

Carbon Arc's framework-based approach reimagines how data should be accessed and priced. At its core, our approach recognizes that every data interaction follows the same elegant structure:

Entity + Insight + Filters = Value

- Entity: The subject of analysis (company, brand, person, location, commodity)

- Insight: The specific data point or analytical output you need

- Filters: The dimensions that matter to your use case (space, time, industry, size, etc.)

Exhibit 1:

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemodel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}

Exhibit 2:

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemakel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}

Exhibit 3:

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemakel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}

Exhibit 4:

Framework={"insight": {"insight_id": 3741},"entities": [{"carc_name": “*”,"representation": "state"}],"filters": {"date_resolution": "day","location_resolution": "state","date_range": {"start_date": "2023-08-01","end_date": "2025-08-20"},"active_worker": "*","employee_type": ["Full Time"],"state": "*"},"aggregate": "mean"}

Exhibit 5:

Framework={"insight": {"insight_id": 5382},"entities": [{"carc_name": “*”,"representation": "state"}],"filters": {"date_resolution": "day","location_resolution": "state","date_range": {"start_date": "2024-06-01","end_date": "2025-06-30"},"active_worker": "*","employee_type": ["Full Time"],"state": "*"},"aggregate": sum"}

Exhibit 6:

Framework={"insight": {"insight_id": 5382},"entities": [{"carc_name": “*”,"representation": "state"}],"filters": {"date_resolution": "day","location_resolution": "state","date_range": {"start_date": "2024-06-01","end_date": "2025-06-30"},"active_worker": "*","employee_type": ["Full Time"],"state": "*"},"aggregate": sum"}

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemodel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2024-06-01","end_date": "2025-06-30"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}

Exhibit 7:

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemodel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}

Carbon Arc Carvana Web Data (available via bulk download)

Exhibit 8:

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemodel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}

Carbon Arc Carvana Web Data (available via bulk download)

Contact us at support@carbonarc.co if you have any questions!