Economic Spotlight

Carbon Arc Data Assets: Trade Claims, Clickstream, Credit Card – US Complete Panel, Housing Permits, Vehicle Registration, Home Depot Inventory

Effects on Consumer and Industrial Goods

October 3, 2025

Executive Summary

Starting in early April1, the U.S. has made substantial changes to its global trade policy that impact supplier2 and consumer behavior. Reciprocal tariffs first announced on April 23 have made it more expensive to ship freight into the U.S., and the closing of the de minimis exemption has impacted small shipments and marketplaces like eBay and Temu4. This week’s Economic Spotlight (1) provides a brief overview of tariff impact on the U.S.’s top trading partners and import categories, (2) analyzes how tariffs and changes to the de minimis exemption are impacting the behavior of brands and retailers, and (3) highlights potential impacts on the housing and autos sectors.

Key Takeaways

-

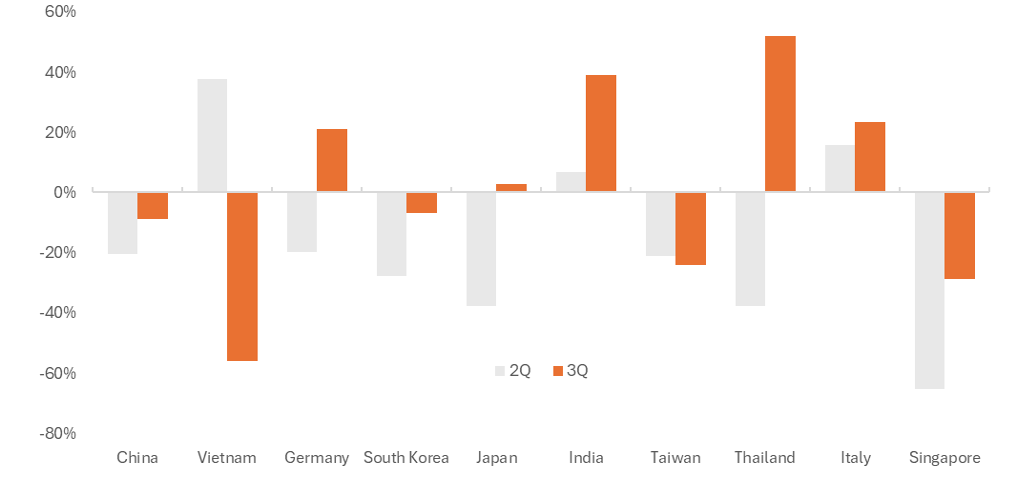

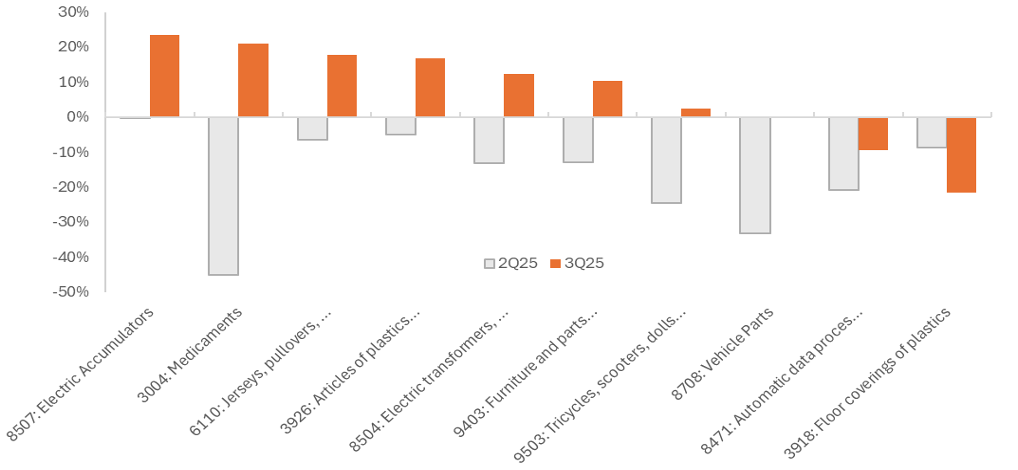

Trade volumes for the top harmonized system (HS) codes and with most of the U.S.’s top trading partners declined Y/Y in 2Q but rebounded in 3Q. Imports from Vietnam are down the most Y/Y in 3Q after being up the most Y/Y in 2Q, suggesting pull-forward of orders.

-

Trade claims data for consumer brands shows Adidas reducing import share from high-tariff countries and introducing imports from Singapore, with no clear impact on transaction values. Vuori has continued to increase its share of imports from Vietnam Y/Y despite the introduction of tariffs but in 1Q had imported primarily from high-tariff countries. Average transaction values reached their highest levels in the last 12 months in September.

-

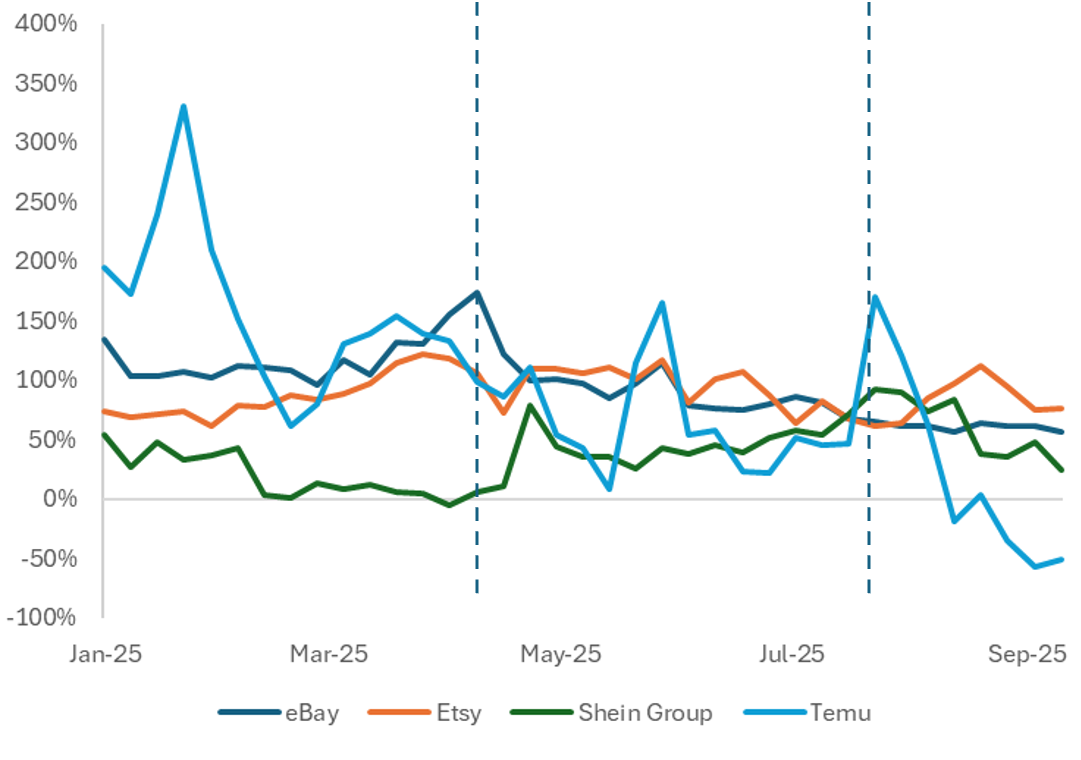

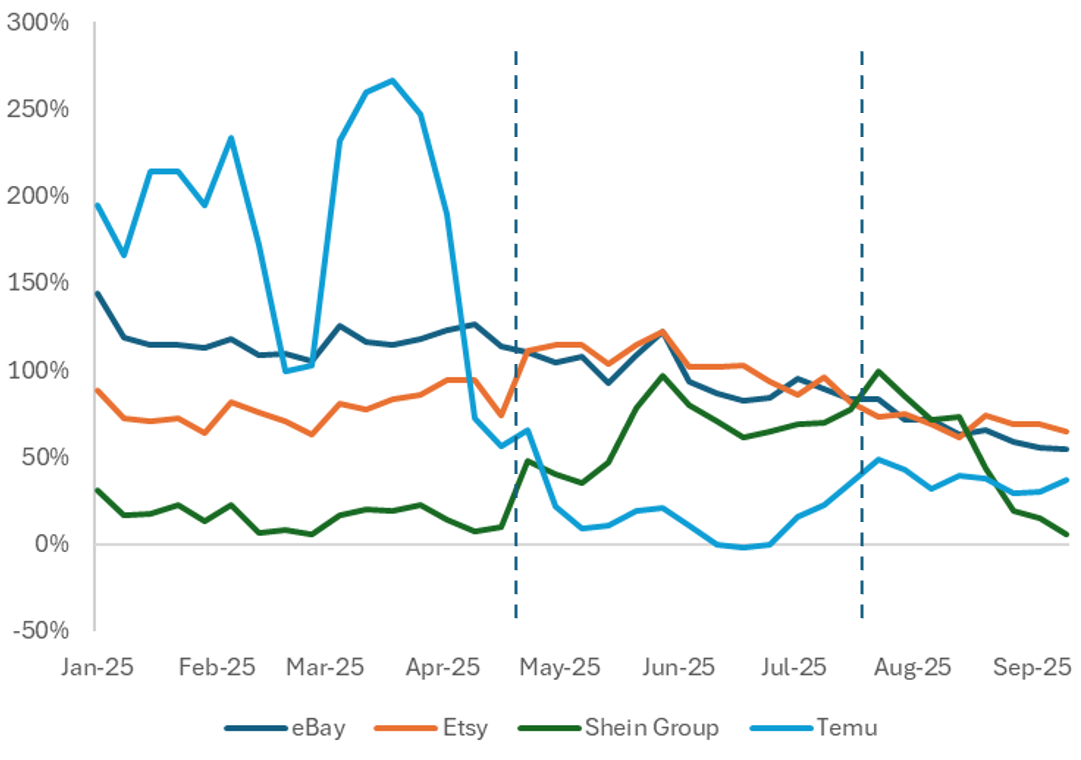

Retailers impacted by changes to the de minimis exemption showed mixed reactions from consumers, with Temu showing a significant Y/Y deceleration in web users and card transactions growth in April despite little overall change in transaction values. Shein card transactions briefly declined Y/Y but recovered as average transaction values declined following a pre-tariff spike. eBay showed a slight decrease in card transactions following the broader revocation of the de minimis exemption in August but otherwise eBay and Etsy have shown similarly consistent trends throughout 2025.

-

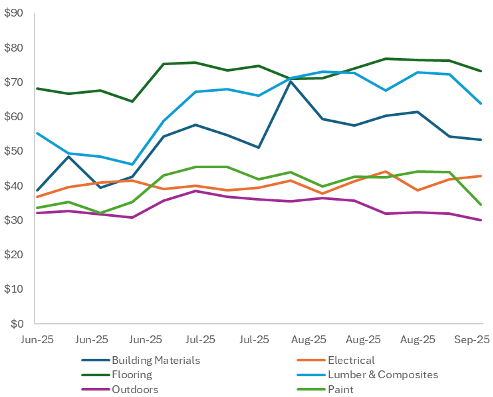

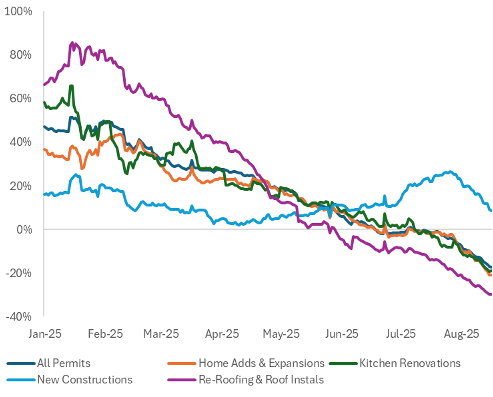

Prices of building materials at Home Depot increased throughout summer 2025 and permit applications maintained a consistent downward deceleration pre- and post-Liberation Day.

-

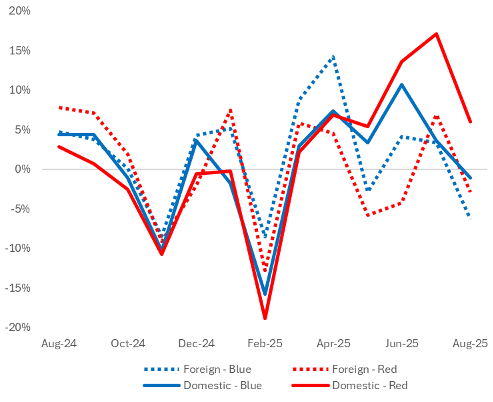

As previously highlighted by Carbon Arc, sales of domestically-assembled vehicles continue to grow faster than sales of imported vehicles, particularly in red states.

Tariff Impact Overview

Following the immediate introduction of “reciprocal tariffs” on April 2, shipments to the U.S. were expected to slow, but the additional 90-day pause created a window to import goods without tariffs. Despite this activity, imports were down Y/Y in 2Q across the 10 HS Codes with the greatest historic import value in our data. Delays that allowed inventory to run down likely drove the Y/Y increases in 3Q.

Of the U.S.’s primary maritime trading partners, Vietnam had the largest Y/Y increase in U.S. import value in 2Q, likely driven by the high 46% tariff. While trade volume with most partners rebounded in 3Q, trade with China was still down Y/Y and trade with Taiwan further decelerated.

Exhibit 1: Y/Y Change in Import Value by Exporting Country

Exhibit 2: Y/Y Change in Import Value for 10 Largest HS Codes in Bill of Lading Data

Consumer Brands and Tariffs

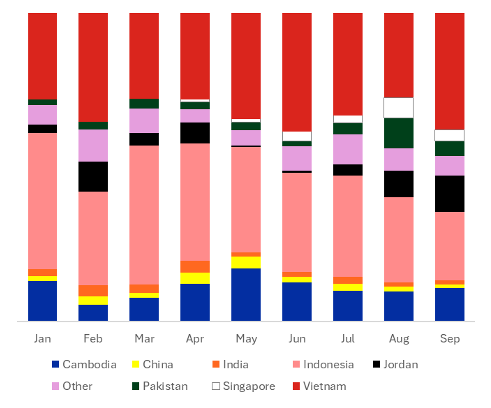

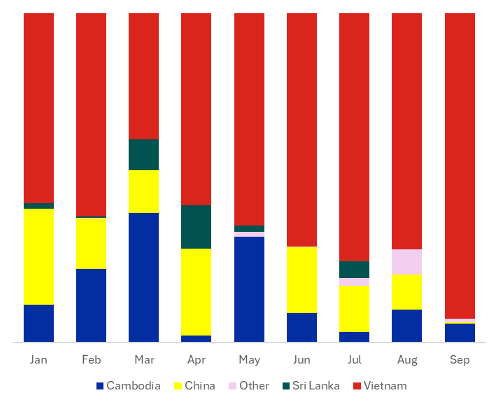

Adidas imports goods from a variety of countries (Ex.3) while Vuori primarily imports from Vietnam, Cambodia, and China (Ex.4). Following Liberation Day, Adidas began importing goods from Singapore, which did not have a reciprocal tariff, and decreased the share of imports from Indonesia.

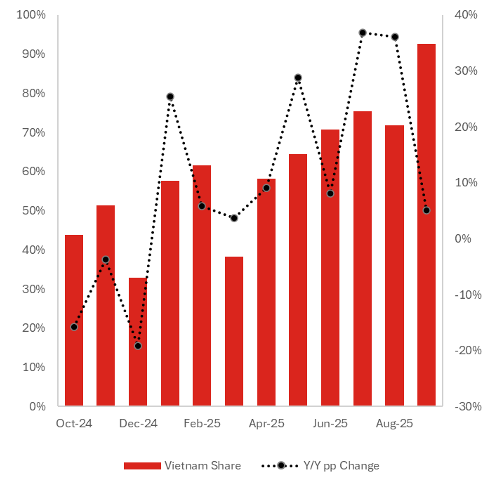

Vuori has been steadily increasing its share of imports from Vietnam (Ex.5) despite the 46% tariff rate, with positive Y/Y growth in every month since January. Cambodia and China still had higher tariff rates, likely limiting Vuori’s ability to find lower tariff rates.

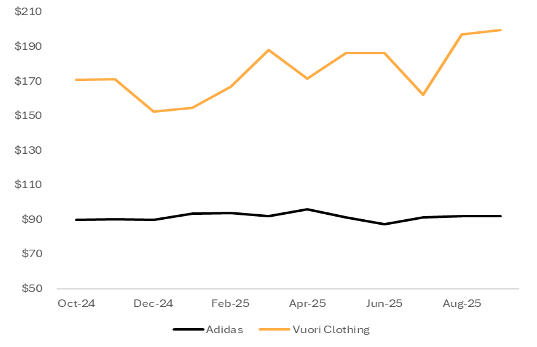

Adidas’s DTC transaction values did not increase following the introduction of tariffs. Vuori’s increased over the summer to a 12-month high in September, suggesting a likelier tariff impact on pricing.

Exhibit 3: Share of Adidas Imports by Country

Exhibit 4: Share of Vuori Imports by Country

Exhibit 5: Vuori Share of Imports from Vietnam (l) and Y/Y pp Growth (r)

Exhibit 6: DTC Card Average Transaction Value

Fast Fashion, Marketplaces, and “de minimis”

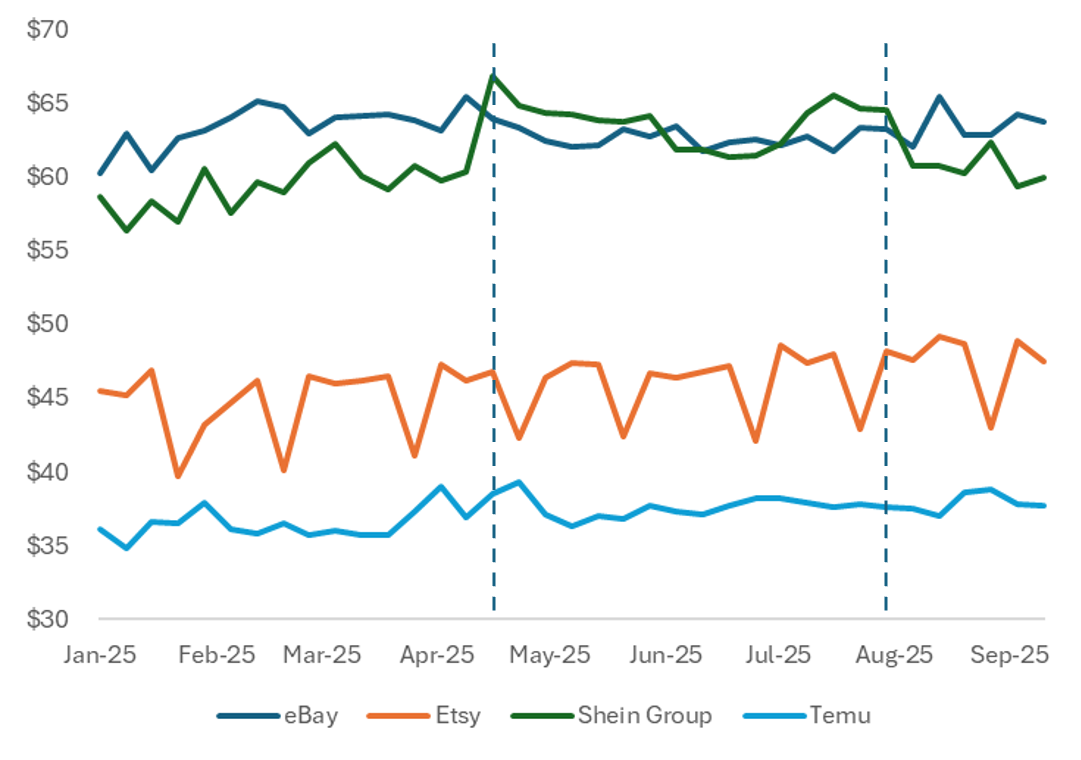

The end of the de minimis exemption on tariffs for small packages is expected to significantly impact marketplaces like Etsy, eBay, and Temu, as well as fast fashion retailers like Shein. Tariffs on de minimis packages may impact the consumer when purchasing upfront, with increased item fees and shipping Delivered Duty Paid (DDP) or paid by the consumer to the postal carrier upon arrival if shipped Delivered Duty Unpaid (DDU). If tariffs are paid directly to the courier, transaction value would not change but the increased cost of goods could reduce purchase frequency.

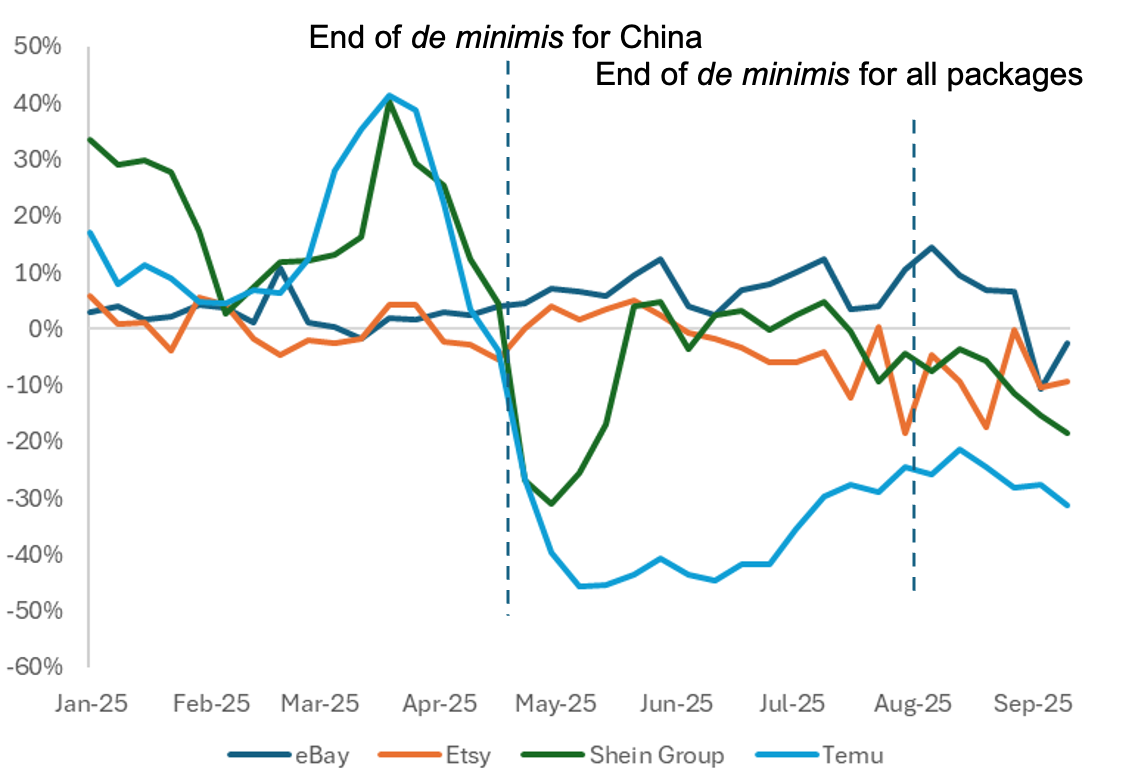

Following the end of the de minimis exemption on packages from China, transactions for both Temu and Shein fell sharply. Shein has attempted to make larger shipments to lower transaction costs, and transaction volumes have recovered somewhat. Transaction values only increased ~10% for Shein in early April and have fallen back to early 2025 levels. Temu transaction values changed by a similarly modest amount, but transaction growth sharply decelerated and has stayed negative since the start of tariffs. Web users growth also fell substantially, suggesting even the perceived threat of tariffs could be driving consumers away.

Web traffic and users growth accelerated for Shein, suggesting other platforms may be passing on greater impacts to consumers. Traffic and users growth for eBay and Etsy has remained relatively constant over time.

Transaction growth for eBay slowed in September, shortly after the end of de minimis exemptions for all countries, while Etsy transaction volumes remained level.

Exhibit 7: Weekly Card Transactions Y/Y Growth

Exhibit 8: Average Transaction Value

Exhibit 9: Web Traffic Y/Y Growth

Exhibit 10: Web Users Y/Y Growth

Tariff Impact on Consumer Industrials

Autos and housing are the two primary avenues for consumer spending on industrial goods and are both experiencing tariff impacts. Many vehicles and parts are made outside the U.S. and raw building materials like lumber are frequently imported.

Home Depot inventory data tracks how tariffs may be making building inputs more expensive, as the median price of building material and lumber SKUs at Home Depot increased throughout the summer.

Permit application growth was not impacted by the introduction of tariffs but has been on a decelerating trend overall. New constructions continue to grow Y/Y but home additions and kitchen renovations have tracked similarly downward over the past 6 months. Re-roofing is down significantly but the U.S. has faced fewer major storms this summer.

Vehicle registration data shows consumers are shifting towards domestically-assembled vehicles, which will be less impacted by tariffs, as previously observed in another Carbon Arc report.

Exhibit 11: Median Item Price at Home Depot by Category

Exhibit 12: Y/Y Housing Permit Application Growth by Type, 28-Day Moving Average

Exhibit 13: New Vehicle Registration Growth for Domestically-Assembled vs. Imported Vehicles

References

-

Congress.gov / Congressional Research Service. “Presidential 2025 Tariff Actions: Timeline and Status.” CRS Product R48549, accessed October 2, 2025.https://www.congress.gov/crs-product/R48549

-

The Wall Street Journal. “Here’s How Companies Are Dealing With $50 Billion in Trump Tariffs.” The Wall Street Journal, July 31, 2025. https://www.wsj.com/economy/trade/trump-tariff-main-street-business-impact-866cc403

-

CBS News. “See the Full List of Reciprocal Tariffs by Country From Trump’s ‘Liberation Day’ Chart.” CBS News, April 9, 2025. https://www.cbsnews.com/news/trump-reciprocal-tariffs-liberation-day-list/

-

ABC News. “What Does the Closure of the De Minimis Loophole Mean for Shoppers?” ABC News, August 29, 2025. https://www.abcnews.go.com/Business/closure-de-minimis-loophole-shoppers/story?id=125090648

Methodology

Carbon Arc's framework-based approach reimagines how data should be accessed and priced. At its core, our approach recognizes that every data interaction follows the same elegant structure:

Entity + Insight + Filters = Value

- Entity: The subject of analysis (company, brand, person, location, commodity)

- Insight: The specific data point or analytical output you need

- Filters: The dimensions that matter to your use case (space, time, industry, size, etc.)

Exhibit 1:

Framework = {"insight": {"insight_id": 667},"entities": {"carc_id": 96,"representation": "country"},"filters": {"date_resolution": "month","location_resolution": ”country","date_range": {"start_date": "2023-04-01","end_date": "2025-09-30"},”exporting_country": "*",”harmonized_system_category": "*”,”transportation_mode_name”:[“Maritime”]},"aggregate": "sum"}

Exhibit 2: Same as Exhibit 1.

Exhibit 3:

Framework = {"insight": {"insight_id": 586},"entities": {"carc_id": 30245,"representation": ”product"},"filters": {"date_resolution": "month","location_resolution": ”country","date_range": {"start_date": "2025-01-01","end_date": "2025-09-30"},”exporting_country": "*",“importing_country”: “United States of America”, ”harmonized_system_category":"*”, ”transportation_mode_name”:[“Maritime”]}, "aggregate": "sum"}

Exhibit 4:

Framework = {"insight": {"insight_id": 586},"entities": {"carc_id": 54178,"representation": ”product"},"filters": {"date_resolution": "month","location_resolution": ”country","date_range": {"start_date": "2025-01-01","end_date": "2025-09-30"},”exporting_country": "*",“importing_country”: “United States of America”, ”harmonized_system_category":"*”, ”transportation_mode_name”:[“Maritime”]}, "aggregate": "sum"}

Exhibit 5: Same as Exhibit 4.

Exhibit 6:

Framework = {"insight": {"insight_id": 765},"entities": [{"carc_id": 30245,"representation": ”product"}, {"carc_id": 54178,"representation": ”product"}],"filters": {"date_resolution": "month","location_resolution": ”us","date_range": {"start_date": "2024-10-01","end_date": "2025-09-30"},”transaction_method": "*"}, "aggregate": "sum"}

Framework = {"insight": {"insight_id": 766},"entities": [{"carc_id": 30245,"representation": ”product"}, {"carc_id": 54178,"representation": ”product"}],"filters": {"date_resolution": "month","location_resolution": ”us","date_range": {"start_date": "2024-10-01","end_date": "2025-09-30"},”transaction_method": "*"}, "aggregate": "sum"}

Exhibit 7:

Framework = {"insight": {"insight_id": 766},"entities": [{"carc_id": 23219,"representation": ”retailer"}, {"carc_id": 55576,"representation": ”retailer"}, {"carc_id": 55416,"representation": ”retailer"}, {"carc_id": 37408,"representation": ”retailer"}],"filters": {"date_resolution": ”week","location_resolution": ”us","date_range": {"start_date": "2024-01-01","end_date": "2025-09-30"},”transaction_method": "*"}, "aggregate": "sum"}

Exhibit 8:

Framework = {"insight": {"insight_id": 765},"entities": [{"carc_id": 23219,"representation": ”retailer"}, {"carc_id": 55576,"representation": ”retailer"}, {"carc_id": 55416,"representation": ”retailer"}, {"carc_id": 37408,"representation": ”retailer"}],"filters": {"date_resolution": ”week","location_resolution": ”us","date_range": {"start_date": "2025-01-01","end_date": "2025-09-30"},”transaction_method": "*"}, "aggregate": "sum"}

Framework = {"insight": {"insight_id": 766},"entities": [{"carc_id": 23219,"representation": ”retailer"}, {"carc_id": 55576,"representation": ”retailer"}, {"carc_id": 55416,"representation": ”retailer"}, {"carc_id": 37408,"representation": ”retailer"}],"filters": {"date_resolution": ”week","location_resolution": ”us","date_range": {"start_date": "2025-01-01","end_date": "2025-09-30"},”transaction_method": "*"}, "aggregate": "sum"}

Exhibit 9:

Framework = {"insight": {"insight_id": 8928},"entities": [{"carc_id": 23219,"representation": ”retailer"}, {"carc_id": 55576,"representation": ”retailer"}, {"carc_id": 55416,"representation": ”retailer"}, {"carc_id": 37408,"representation": ”retailer"}],"filters": {"date_resolution": ”week","location_resolution": ”us","date_range": {"start_date": "2024-01-01","end_date": "2025-09-30"},”platform_name": "*"}, "aggregate": "sum"}

Exhibit 10:

Framework = {"insight": {"insight_id": 8930},"entities": [{"carc_id": 23219,"representation": ”retailer"}, {"carc_id": 55576,"representation": ”retailer"}, {"carc_id": 55416,"representation": ”retailer"}, {"carc_id": 37408,"representation": ”retailer"}],"filters": {"date_resolution": ”week","location_resolution": ”us","date_range": {"start_date": "2024-01-01","end_date": "2025-09-30"},”platform_name": "*"}, "aggregate": "sum"}

Exhibit 11: Carbon Arc Home Depot Inventory Data (available via bulk download)

Exhibit 12:

Framework={"insight": { "insight_id": 308}, "entities": [ {"carc_name": "*", "representation": ”zip"}], "filters": {"date_resolution": ”day","location_resolution": ”zip","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},”permit_classifier": “*”,”permit_status": [“Applied”]},"aggregate": "sum"}

Exhibit 13:

Framework={"insight": { "insight_id": 309}, "entities": [ {"carc_name": “*”, "representation": "vehiclemodel"}], "filters": {"date_resolution": "month","location_resolution": "state","date_range": {"start_date": "2022-08-01","end_date": "2025-08-20"},"sold_as": ["New"],"state": "*"},"aggregate": "sum"}