Economic Spotlight: Q3 2025 Small & Mid-Sized Business Payrolls

Carbon Arc Data Assets: SMB Workforce, Credit Card – US Complete Panel, Housing Permits Vehicle Registrations

A Challenging Economic Environment & Impacts on Regional Communities

October 23, 2025

Executive Summary

Small & mid-sized business payrolls and wages provide a compelling illustration of a difficult economic environment defined by a contracting workforce and slowing salary growth. Differences emerge across the nine census regions, manifesting in varying changes in the amount of discretionary credit card spend, the number of permit applications for home improvements, and the number of new/used vehicle registrations. Carbon Arc's data assets can be drawn upon to capture the dynamics behind major economic indicators, uncovering early signals of broader economic trends, while access to traditional sources becomes increasingly unreliable.

Key Takeaways

-

Carbon Arc's SMB workforce payroll data asset indicates a 4.6% Y/Y decline in unique workers in Q3 2025 with the full-time workforce declining by 5.5% Y/Y and by 0.97% from Q2 2025.

-

Wage data indicates a Y/Y full-time salary change of +2.9% in Q3 2025, dipping below 3% for the first time since Q2 2024.

-

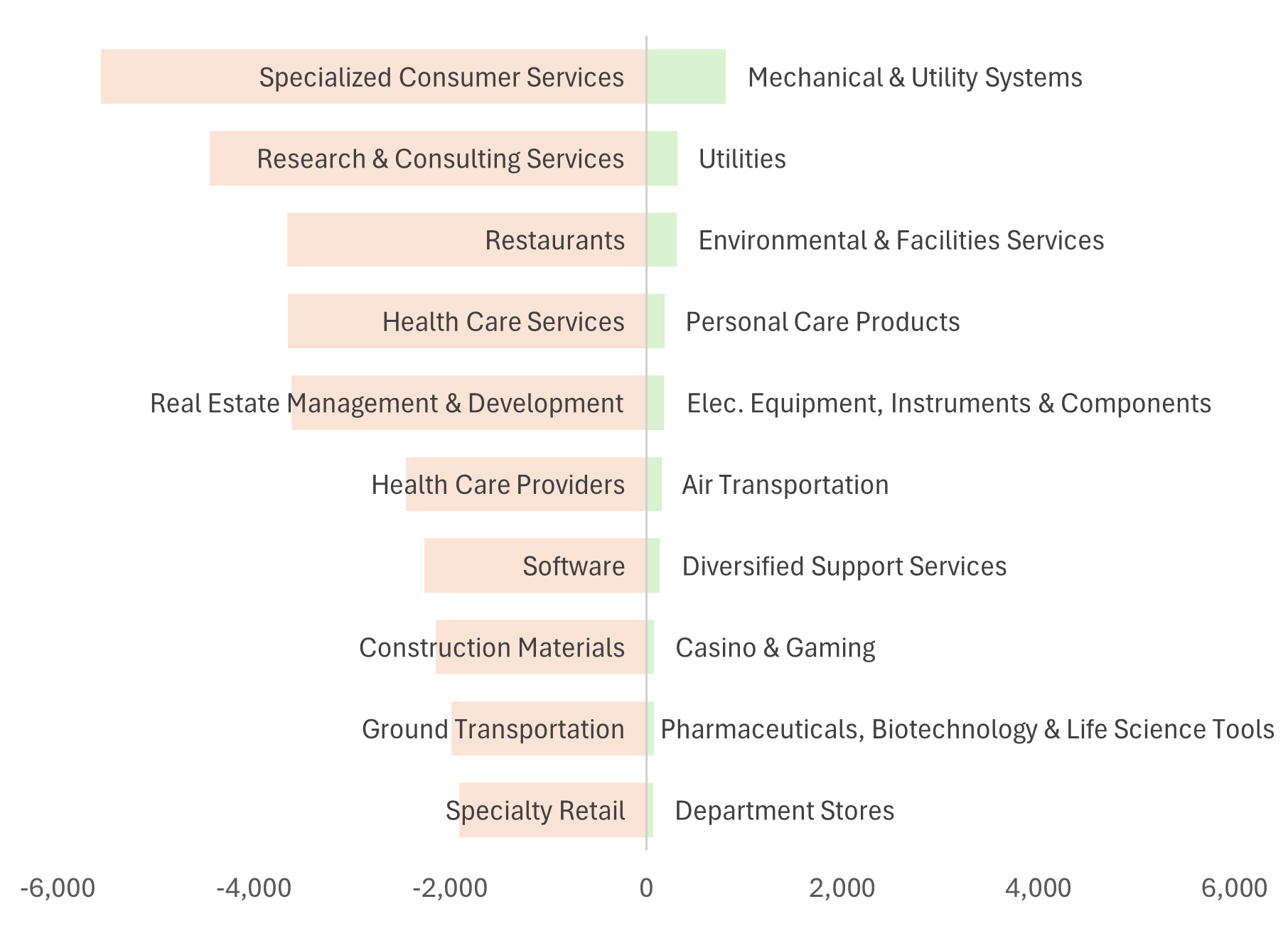

Employers in the Specialized Consumer Service, Research & Consulting Service and Restaurant space lost the most full-time jobs during the quarter. Any job gains by category were relatively small, but Mechanical & Utility Systems added most.

-

On a regional basis, the Pacific and West North Central regions had the largest workforce reductions, both well beyond the full-time national rate, and the Pacific region had the largest reduction of SMB dollars flowing into its communities.

-

Broadline Retail was the only major discretionary category indicating most regions increasing spend Y/Y (New England and the Pacific being the exceptions), while the Food & Beverage Retail sector suffered the most.

-

The data indicates that the decline of dollars into regional communities appears to have an impact on discretionary spending for household improvements and vehicle purchasing patterns. The South Atlantic region had the smallest decline of dollars into its communities and among the smallest declines in permit applications and second highest rate of new vehicle registrations (East South Central).

Q3 2025 SMB Workforce Summary

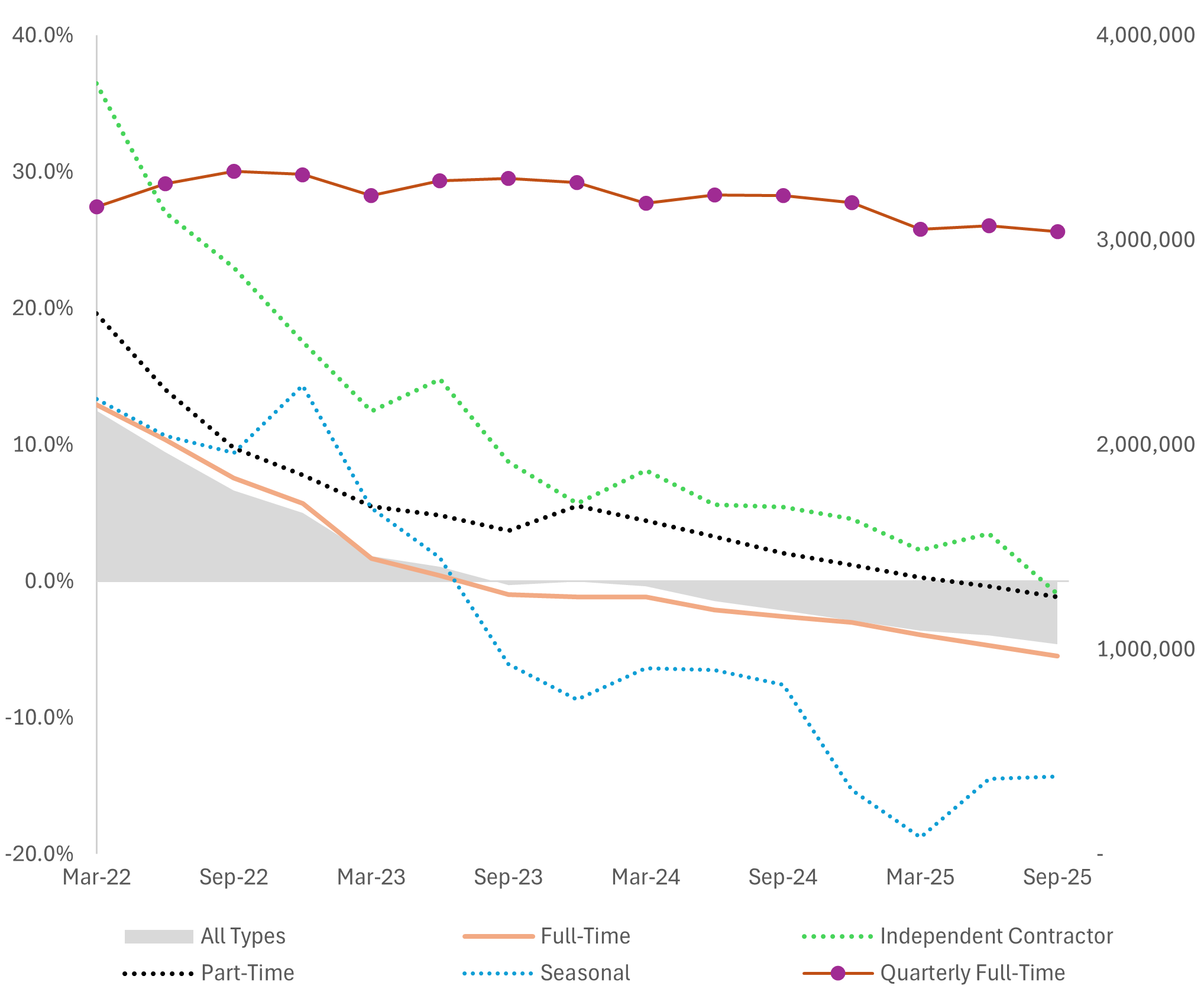

Carbon Arc's SMB workforce payroll data indicates a 4.6% Y/Y decline of unique workers in Q3 2025, with the number of full-time employees declining by 5.5%. The full time workforce contracted by 0.97% from Q2 2025, indicating a loss of 29,776 full-time jobs during the quarter.

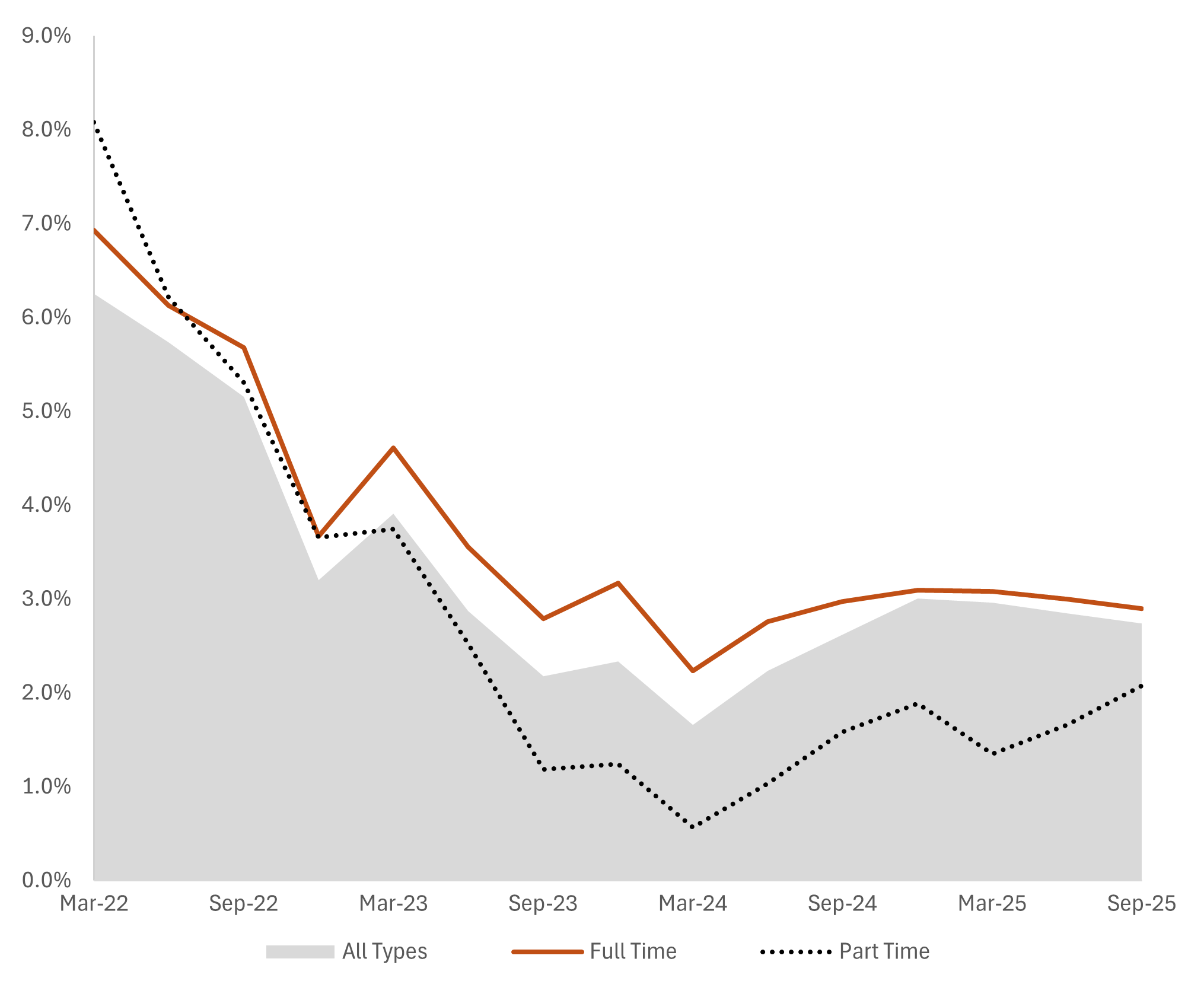

Wage data (Ex.2) suggests the Y/Y increase in salaries for full-time employees was below 3% for the first time since Q2 2024, while the rate of part-time salary increases continued to rise from its Q1 2024 low.

Exhibit 1: Y/Y change in unique worker count by employee type and overall (l) and full-time Q/Q (r)

Exhibit 2: Quarterly Y/Y change in average salary by worker type and overall

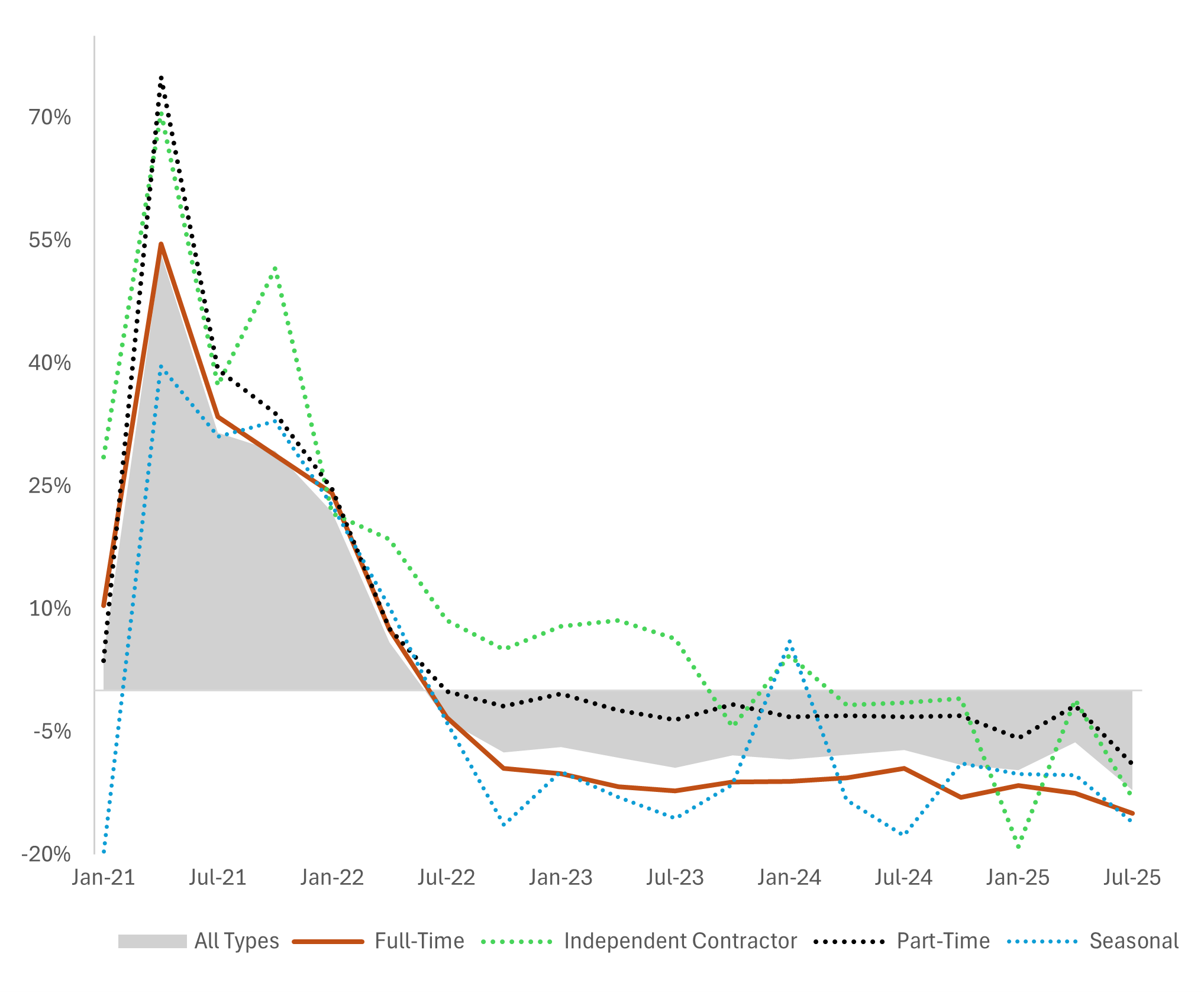

Year-over-year changes in new job starts (Ex.3) also illustrate the challenging environment. Overall new job starts in Q3 2025 declined 12.2% from last year and new full-time starts in Q3 2025 declined 15% from last year, representing the largest declines since pre-COVID. While independent contractors had a significant decline of starts in Q3 2025, the amount of decline did not surpass the Y/Y decline seen in Q1 2025.

Exhibit 3: Y/Y change in new job starts by employee type and overall

Winners & Losers by Employer Category and Region

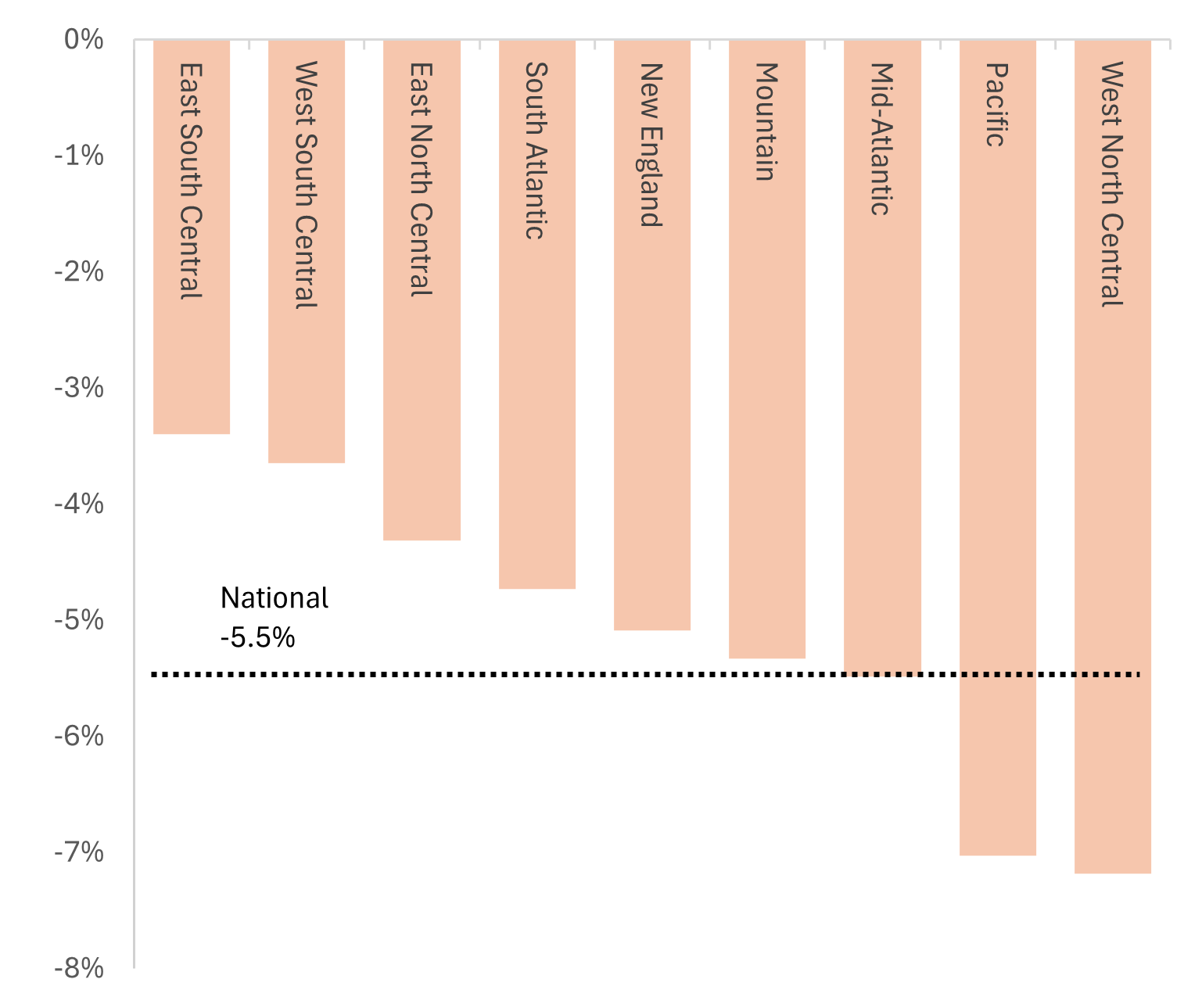

Looking at winners and losers by job categories for SMB full-time workers, Y/Y job losses significantly outpaced any job gains (Ex.4). By employer category, the largest job losses were within the Specialized Consumer and Research & Consulting services. By region, the largest workforce declines were in the West North Central and Pacific regions, both with rates of decline well below the national level for full-time employees (Ex.5).

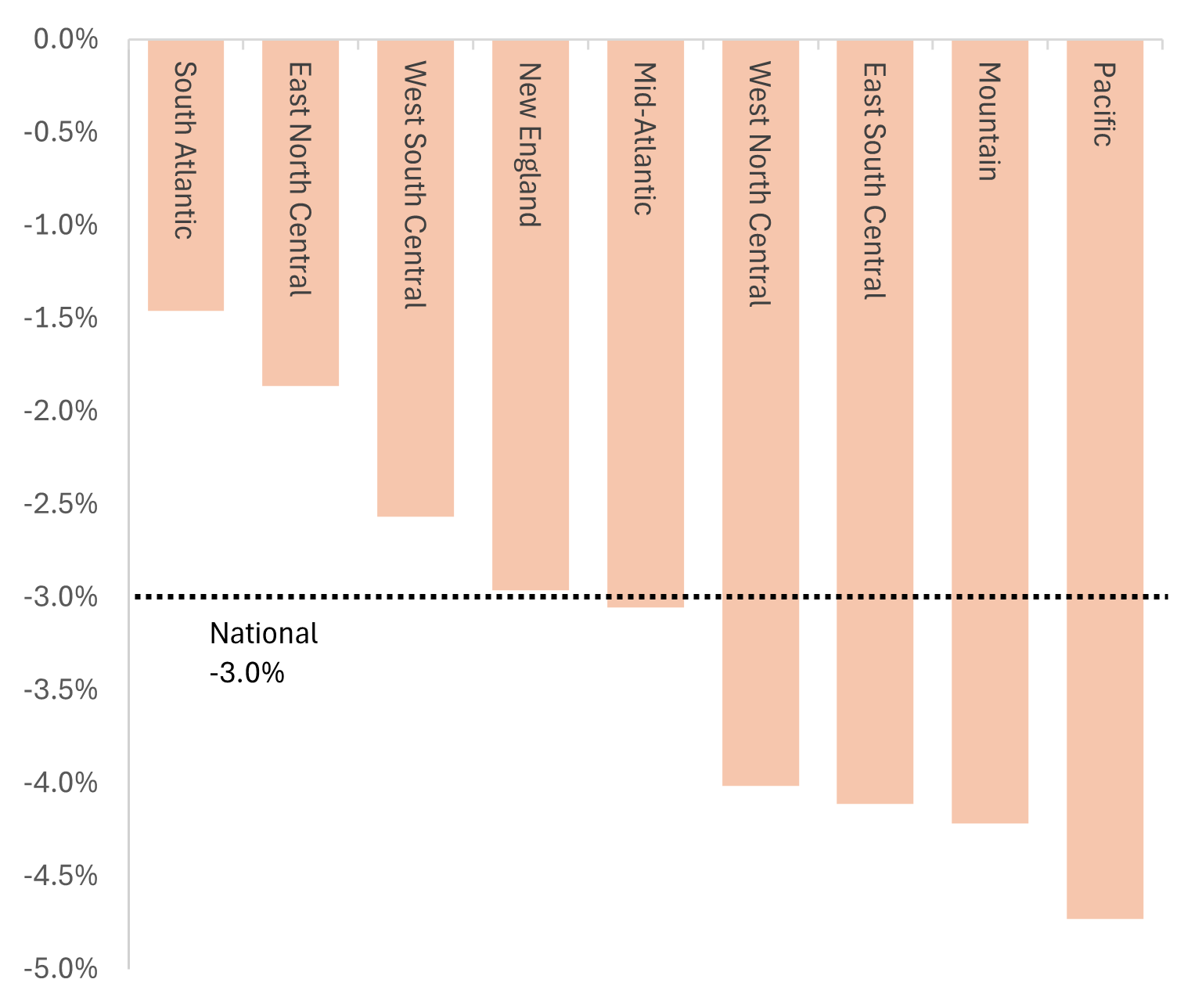

Combining wage and payroll data, we can calculate the Y/Y change in dollars earned on a regional basis (Ex.5) to glean insights on how the SMB workforce is impacting the number of of dollars going into regional communities and any tertiary effects. At the national level, dollars generated from SMB employees declined 3.0% Y/Y with the largest declines coming from the Pacific region (though multiple regions were below the national average decline). The most resilient regions were the South Atlantic, East North and West South Central.

Exhibit 4: Y/Y change in average daily full-time workers by employer category for Q3 2025

Exhibit 5: Y/Y change in unique full-time workers by region for Q3 2025

- National -5.5%

Exhibit 6: Y/Y change in regional dollars earned by worker location

- National -3.0%

Regional Impacts on Discretionary Spending

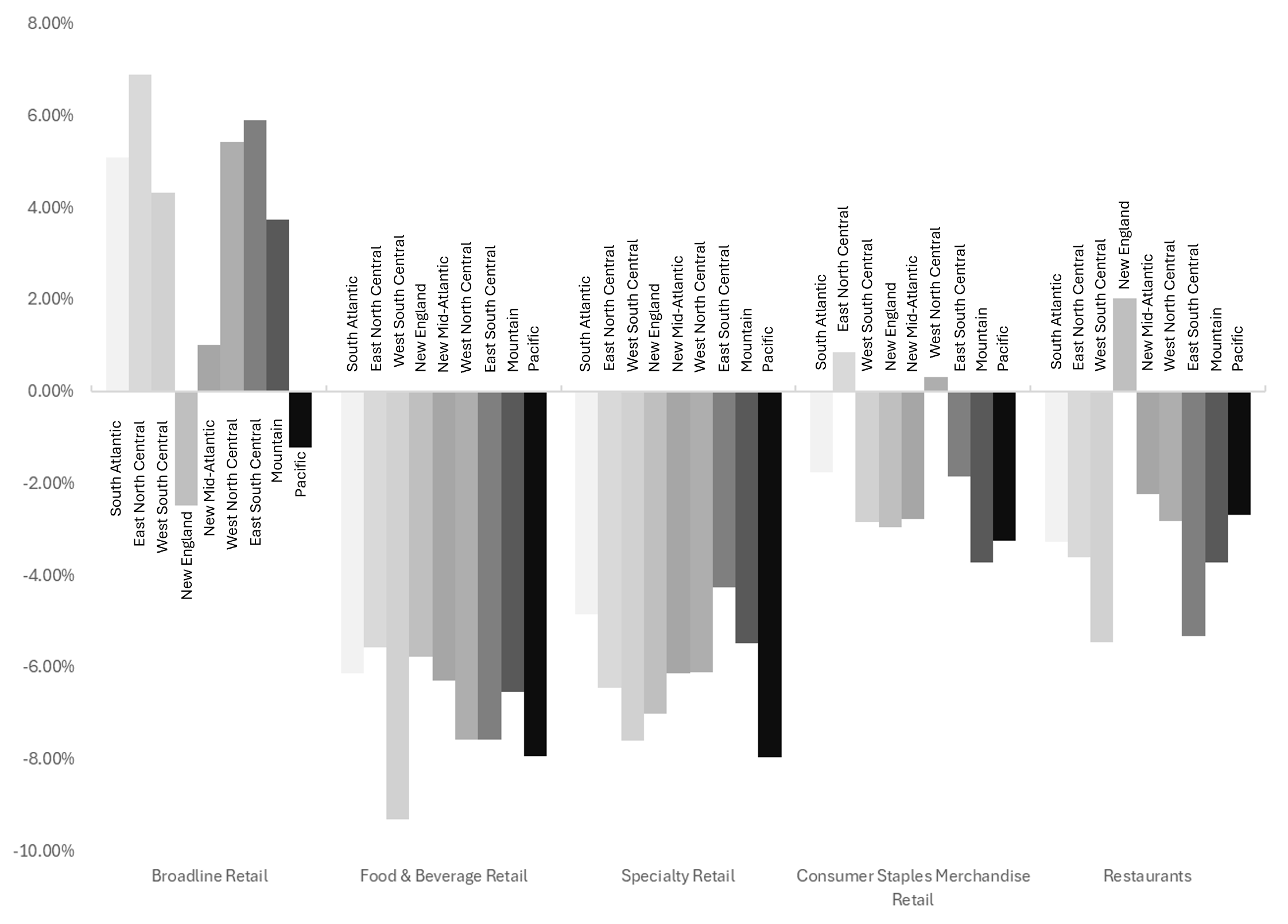

To assess the relationship between the varying economic challenges at the regional level and changes in consumption habits, we show the Y/Y change in regional credit card spend for five major consumer categories (Ex.6) and across additional discretionary segments on the following page.

Aligned with its outsized reduction of SMB employee dollars into the region, the Pacific was the only segment to have Y/Y contractions in credit card spend across all five major discretionary spending categories.

The largest combined Y/Y decline for all regions was within Food & Beverage Retail. With the exception of New England, all regions had Y/Y declines in credit card spend in the Restaurants category. The second least affected category was Consumer Staples Merchandise Retail,showing increased spend from both the East and West North Central regions.

Exhibit 7: Y/Y change in regional card spend for five largest business categories

Additional Discretionary Factors

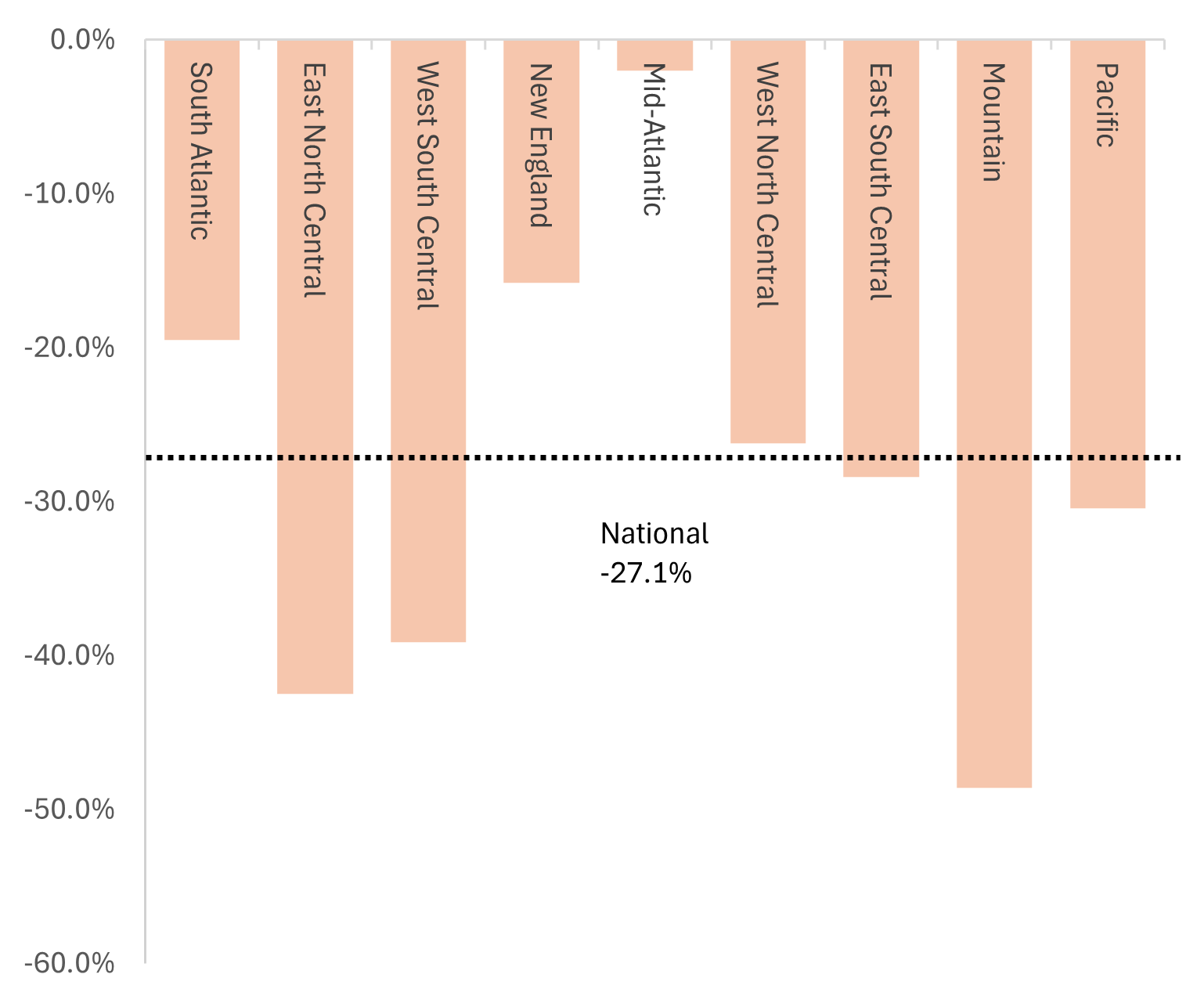

Year-over-year changes in applications submitted for discretionary housing permits (Ex.8) give another view into ancillary effects of declining dollars into regional communities. Across the board, the submission of permits for the most discretionary jobs¹ declined in Q3 2025. The reduction in permit applications can be a result of many factors, including availability of labor and cost of supplies, but the South Atlantic, with the smallest decline in SMB dollars earned into the region showed a relatively low level of decline in permit applications vs. the Mountain region. The Pacific's decline was also greater than the national level.

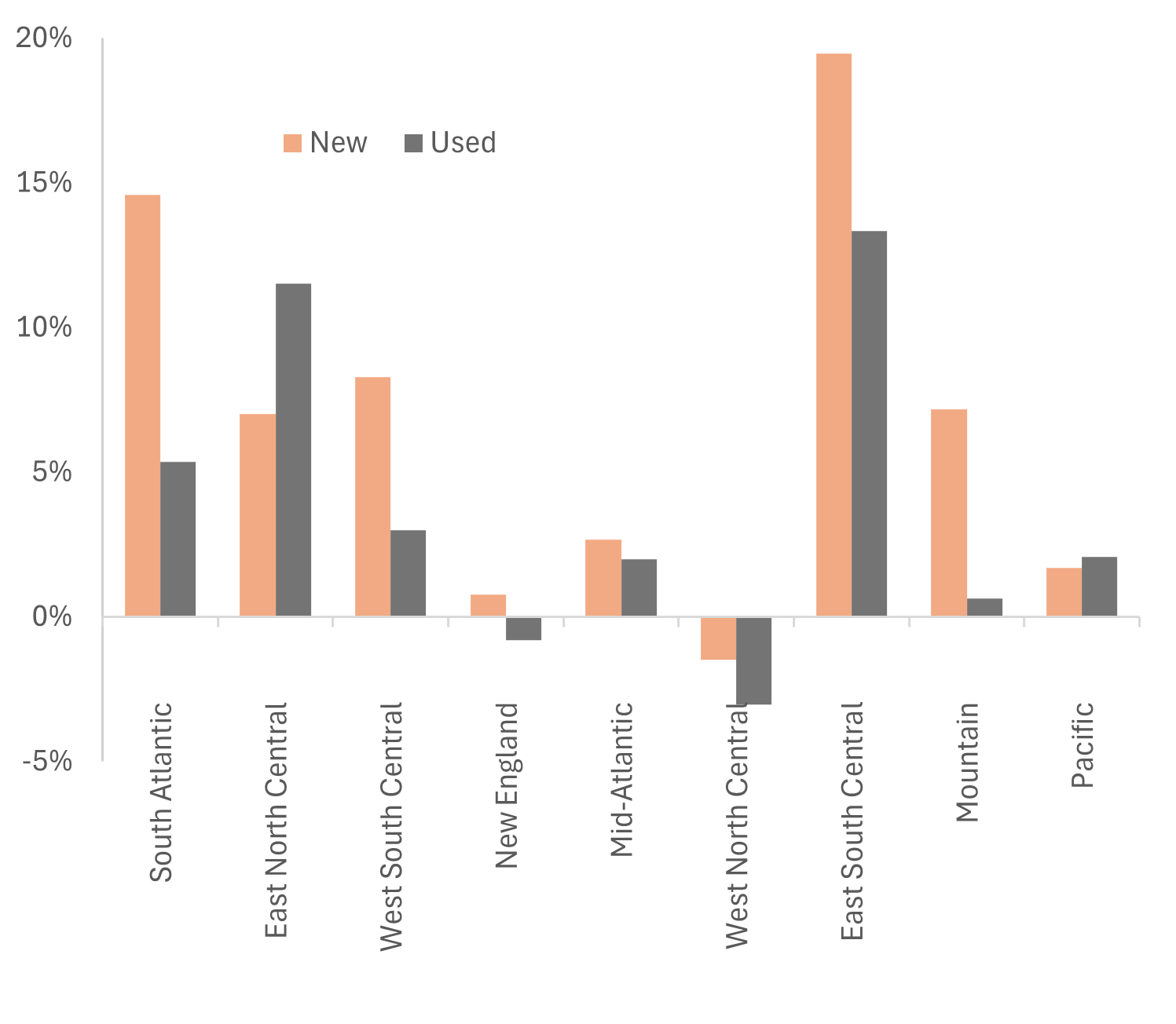

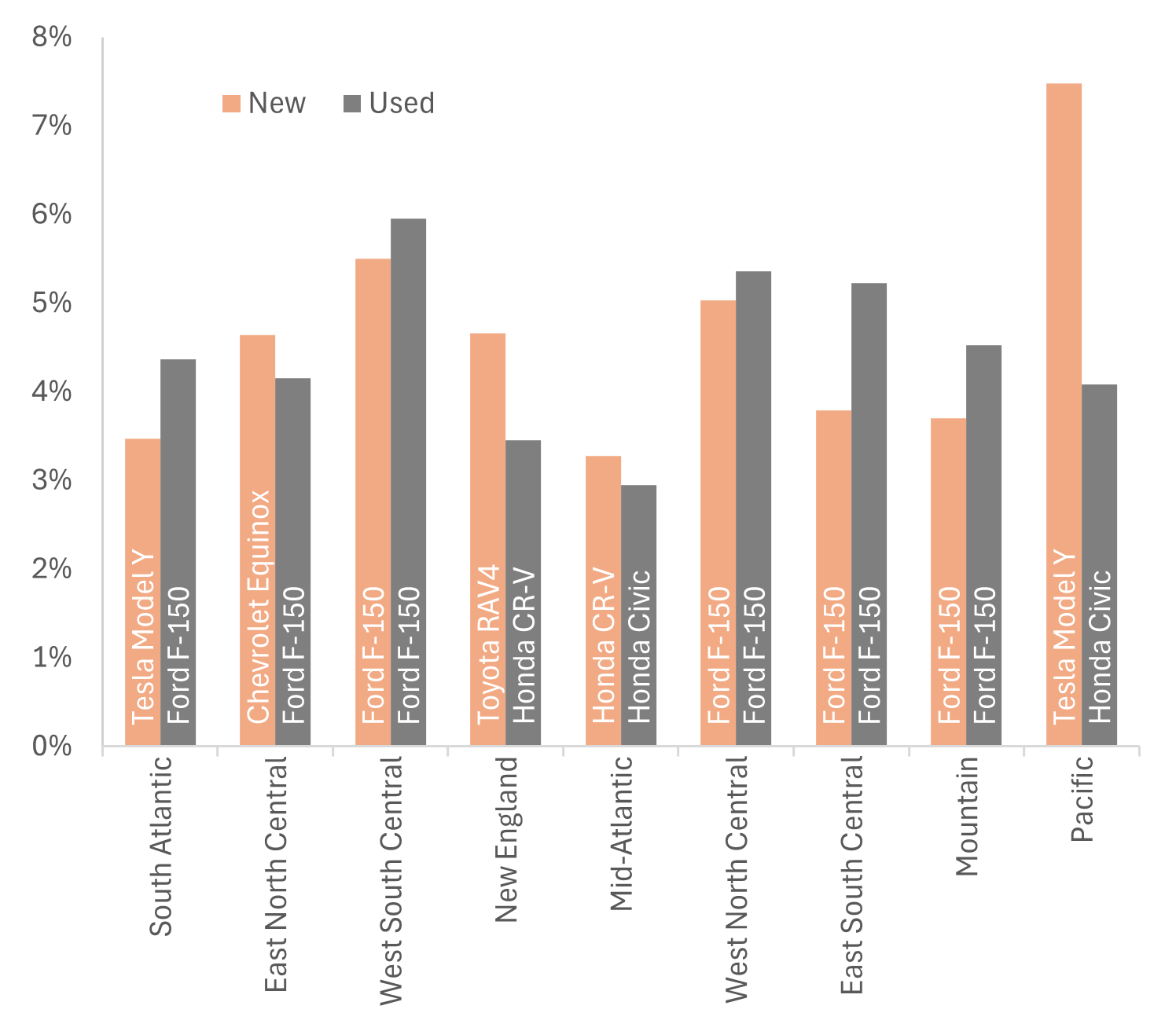

Vehicle registrations for both new and used cars mostly increased Y/Y (Ex.9), with the exceptions being used cars in New England and both new and used cars in the West North Central region. The South Atlantic again showed its relative economic strength with the second highest rate of increase of new car registrations. Exhibit 10 shows which brands were in demand across all regions, for both new and used cars.

Exhibit 8: Q3 2025 Y/Y change in discretionary housing permit applications¹ by region

National -27.1%

Exhibit 9: Q3 2025 Y/Y change in new and used vehicle registrations by region

Exhibit 10: % of all new and used vehicle registrations for most popular make & model

¹Discretionary permits include Bathroom Remodels, Home Additions & Expansions, Kitchen Renovations, Multi-Room Remodels, and Pool & Spa Construction

Questions?

Contact us at support@carbonarc.co if you have any questions!

CARARC-20251024-USSMB-0002